2017 Q4 and Annual Smart Grid, Battery Storage and Efficiency Funding and M&A Report

$599.00 – $799.00

Sector Funding Rises to $1.5 billion in 2017

– Get the Details!

Click here to download our 2017 Q4 and Annual Funding and M&A Executive Summary on Smart Grid, Battery Storage and Efficiency

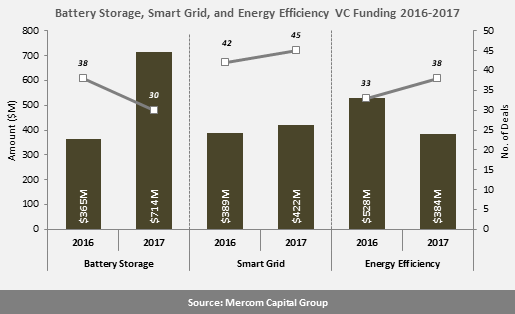

Mercom found that in 2017, a combined $1.5 billion was raised by Battery Storage, Smart Grid, and Energy Efficiency companies, an increase from the $1.3 billion raised in 2016.

Battery Storage

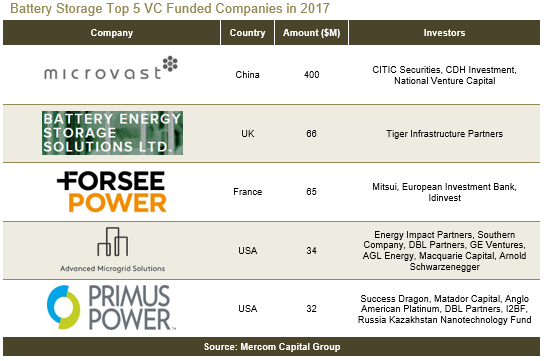

In 2017, VC funding into Battery Storage companies almost doubled to $714 million raised in 30 deals from the $365 million raised in 38 deals in 2016. Total corporate funding, including debt and public market financing, rose to $890 million compared to $540 million in 2016.

Energy Storage Downstream companies received the most funding with $68 million.

There were six M&A transactions in the Battery Storage category in 2017 compared to 11 M&A transactions in 2016.

Smart Grid

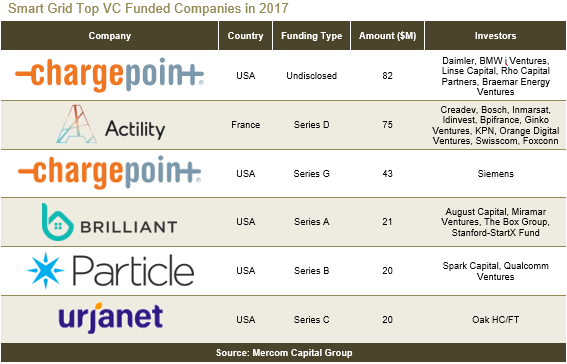

Mercom found that VC funding in the Smart Grid sector rose to $422 million in 45 deals in 2017, compared to $389 million raised in 42 deals in 2016. Total corporate funding, including debt and public market financing, came to $1.2 billion compared to $613 million in 2016.

Smart Charging of plug-in hybrid electric vehicle (PHEV), vehicle-to-grid (V2G) companies, had the largest share of VC funding in 2017 with $155 million in 10 deals.

There were 27 M&A transactions recorded in the Smart Grid sector in 2017 compared to 15 transactions in 2016.

Energy Efficiency

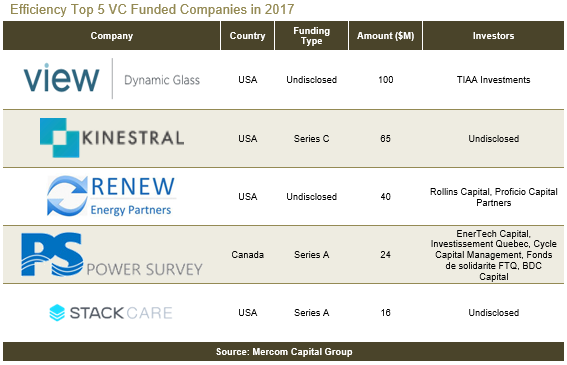

VC funding for the Energy Efficiency sector fell to $384 million in 38 deals in 2017 compared to $528 million in 33 deals in 2016. Total corporate funding, including debt and public market financing, was $3.3 billion, compared to $3.8 billion in 2016.

Efficient Home/Building companies captured the most funding with $172 million in five deals in 2017.

M&A activity for the Efficiency sector in 2017 came to 10 transactions compared to 14 M&A transactions in 2016.

Mercom Capital Group’s Smart Grid, Battery Storage and Efficiency Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the smart grid industry.

The Quarterly Funding and M&A Reports contain year-over-year (YoY) and quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital funding deals including top investors, YoY and QoQ trends, and a breakdown of charts and graphs by stage;

- VC funding by technology;

- Debt and other funding deals;

- Mergers and Acquisitions (M&A) including YoY and QoQ trends, with charts and graphs by technologies;

- Smart Grid funding deals;

- Battery and storage funding deals;

- Energy Efficiency funding deals;

- New cleantech funds;

This report also contains comprehensive lists of all announced deals and transactions during the quarter, including:

- VC deals and investors;

- M&A transactions and acquirers;

- New cleantech funds.

There are 91 companies and investors covered in this report. The report is 128 pages long and contains 122 charts, graphs, and tables.