Mergers and acquisitions (M&A) activity in Digital Health has been flat for the past five consecutive years (2014-2018) before declining slightly in 2019.

Since 2010, we have seen approximately 1,800 M&A transactions in the sector, according to Mercom’s M&A database. Of these transactions, only 328 deals have publicly disclosed the acquisition amount.

Even though consumer-focused technologies have been receiving most of the venture capital funding, practice-focused technologies, solutions that are used by hospitals and clinics, have been the most acquired category so far.

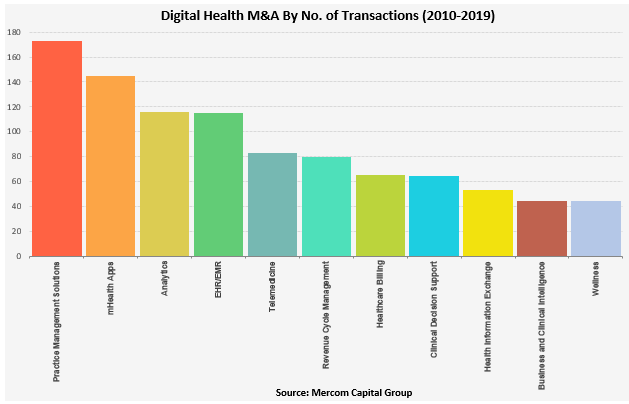

Practice Management Solutions companies led M&A activity with 173 deals, followed by mHealth Apps with 145, Healthcare Data Analytics companies with 116, and Electronic Health Records & Electronic Medical Records companies with 115.

The most active acquirer was Philips, which acquired 13 companies since 2010. CompuGroup Medical and IMS Health each have acquired 12 companies. Allscripts acquired 11 companies, followed by iMedX and Mediware Information Systems, McKesson with ten acquisition each. Quality Systems acquired nine companies. Emdeon, GE Healthcare, athenahealth, and DAS Health acquired eight companies each.

Digital Health M&A activity has spanned 30 countries since 2010. Most of the M&A deals were in the United States where a total of 1,433 companies were acquired, followed by Canada and the United Kingdom with 65 and 49 deals, respectively.

Top disclosed M&A deals since 2010.

French company Dassault Systemes, which provides software to transportation, aerospace, and life sciences companies acquired Medidata, a provider of AI-enabled cloud-based clinical trial analytics software, for $5.8 billion. Medidata’s revenues for fiscal 2018 were $636 million.

Veritas Capital and hedge fund company, Elliott Management, acquired electronic health records company athenahealth for $5.5 billion.

Starr Investment Holdings and Partners Group acquired MultiPlan, a provider of healthcare cost management solutions for $4.4 billion.

Blackstone Capital Partners VI acquired a controlling stake in Emdeon, a provider of healthcare revenue and payment cycle management and clinical information exchange solutions, for $3 billion.

Internet Brands, a KKR portfolio company, acquired popular health information provider WebMD for $2.8 billion.