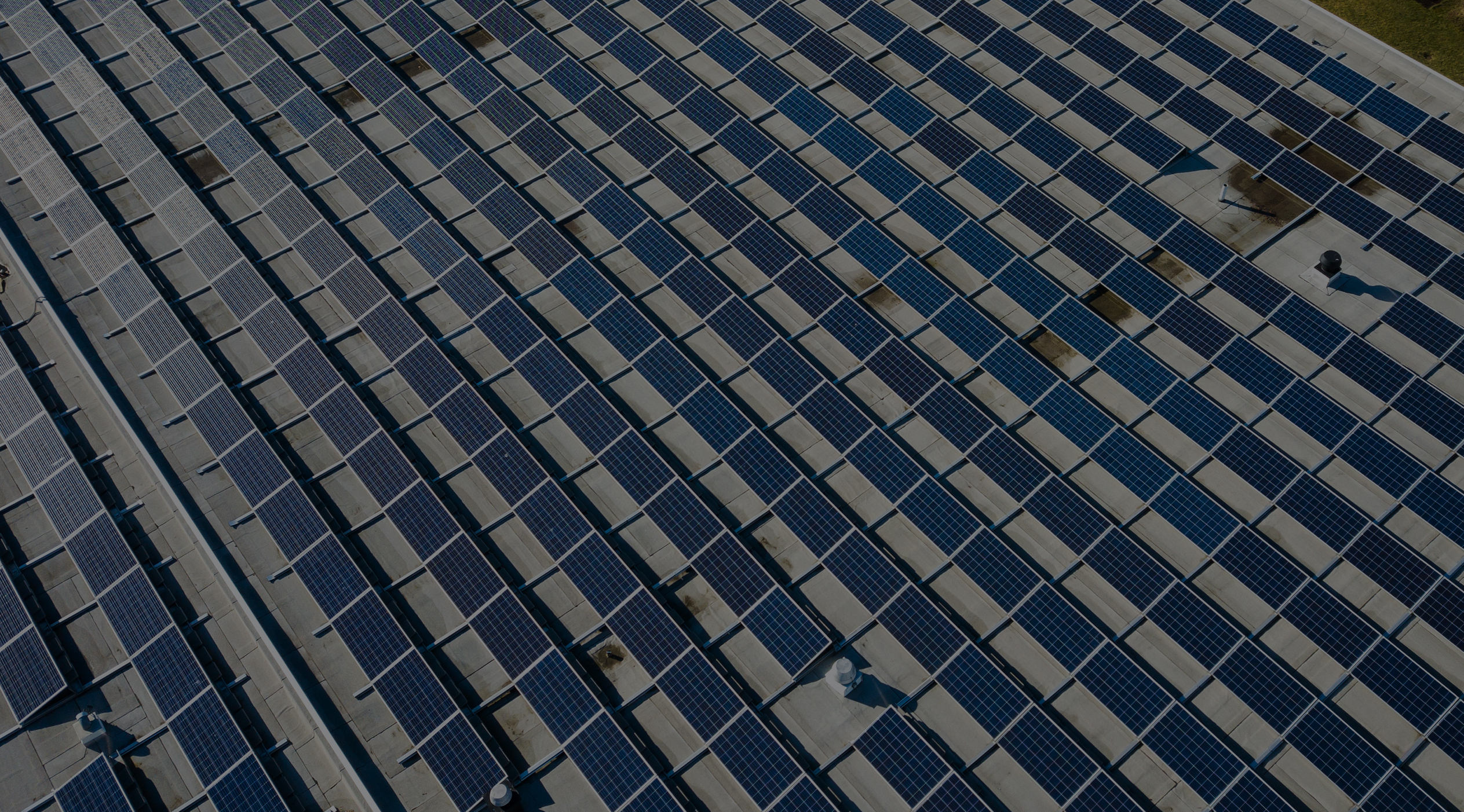

NextPower V ESG (NPV ESG), an OECD Fund of NextEnergy Capital, entered into a binding agreement to acquire a 248 MW solar portfolio comprising 12 solar projects located in Northern Spain.

The portfolio acquisition is NextPower V ESG’s fourth investment. Recently, the fund announced the closing of long-term debt financing for an operational portfolio managed by NextPower III ESG in Spain.

NextPower V ESG’s portfolio includes 348 MW under construction, 116 MW in operations, and over 500 MW in exclusivity or advanced negotiation.

Aldo Beolchini, CIO and Managing Partner at NextEnergy Capital said, “NPV ESG continues to go from strength to strength. This latest investment in Spain shortly follows the recent acquisition in Poland, again demonstrating NEC’s ability to deploy capital quickly and efficiently while highlighting NEC as a market leader in the solar space, with over 360 MW of capacity added to NPV ESG in the last twelve weeks.”

NPV ESG has secured $745 million (including $150 million for co-investments) in total commitments from various investors, including the UK LGPS investment pool and a Dutch pension fund.

NPV ESG’s investment strategy targets the solar+ infrastructure sector in selected OECD markets. The approach involves building significant portfolios in each target market and divesting the portfolio before the fund’s end date in 2033.

According to Mercom’s 1H and Q2 2024 Solar Funding and M&A report, 113 solar project acquisitions totaling 18.5 GW in 1H 2024 were transacted compared to 116 project acquisitions totaling 25.5 GW in 1H 2023.

This week, CleanCapital, a mid-market renewables project financing group, announced the acquisition of two fully operational solar projects totaling 13 MW. BQ Energy Development (BQ) has developed projects that supply clean energy to a local university, healthcare provider, and municipality in upstate New York. Both projects are financed by M&T Bank’s Commercial Equipment Finance Group.