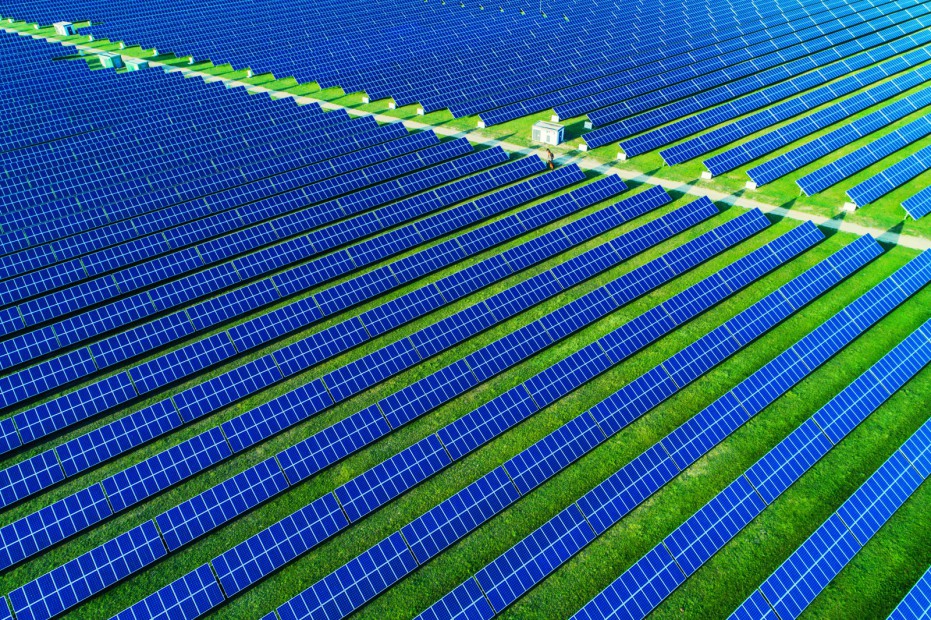

Innova, a developer of utility-scale renewable energy projects, announced the sale of the 25 MW Tolldish Hall solar project to ISG Renewables, a joint venture platform between Innova and Schroders Greencoat.

The solar project is located near Coventry, U.K., and secured planning consent in August 2023. The project is expected to be operational in the first quarter of 2026.

The project was awarded a Contract of Difference (CfD) in Allocation Round 6 (AR6), providing long-term contracted inflation-linked cashflows.

“We’re pleased to see the addition of Tolldish Hall Solar Farm to the ISG Renewables portfolio. As our portfolio grows, we’re not only accelerating the U.K.’s capacity of installed solar but also providing investors the opportunity to access long-term, inflation-linked cashflows. We look forward to building on this momentum with Innova and delivering on our combined ambition to support the U.K.’s provision of a secure supply of energy,” said Matthew Tingle, Investment Director at Schroders Greencoat.

Innova will provide both construction and asset management services for the solar project as part of Innova’s ongoing partnership with Schroders Greencoat.

“I’m delighted to further strengthen our partnership with Schroders Greencoat with the sale of our sixth solar PV project, and second in 2025, contributing significantly towards our shared goal of Net Zero.” “I would also like to extend thanks to TLT as our ongoing legal advisors,” said Christian Miller, Senior Investment Manager at Innova.

The transaction adds to Schroders Greencoat’s portfolio, which now includes more than 141.3 MW of solar PV assets either operational or under construction.

According to Mercom’s Q1 2025 Solar Funding and M&A report, about 13.6 GW of solar projects were acquired in Q1 2025 compared to 10.8 GW in Q1 2024.

Last month, True Green Capital Management, a renewable energy infrastructure investment firm, announced the acquisition of 64 MW of operational solar projects from Ecofin US Renewables Infrastructure Trust PLC through its fourth fund.