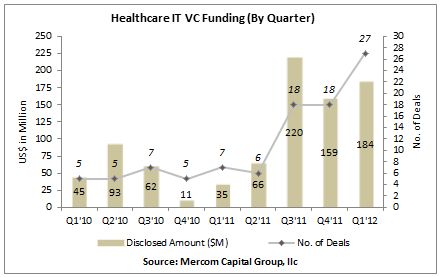

Venture Capital (VC) funding in the healthcare information technology (HIT) sector continued on a strong positive trend that started in the third quarter of 2011. VC funding in Q1 2012 was $184 million in 27 deals, the highest number of deals ever recorded since Mercom started collecting data in Q1 2010. A total of 46 different VCs invested in Q1 and Connecticut Innovations was the only VC to participate in multiple deals. The Health Information Technology for Economic and Clinical Health (HITECH) Act kick started this larger implementation of IT in healthcare in the United States after it was passed in 2009.

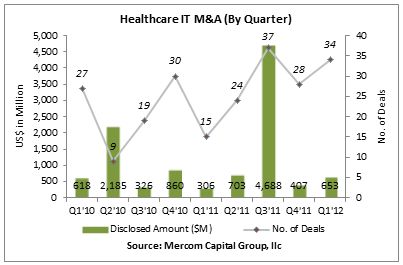

”We are seeing significant momentum in terms of private venture capital funding flowing into the HIT sector, and a robust M&A environment is providing investors and the industry with liquidity and viable exit options,” said Raj Prabhu, Managing Partner of Mercom Capital Group. “Since the first quarter of 2010, M&A transactions have outpaced VC funding transactions by almost two to one (98 VC funding deals, 223 M&A transactions), a positive sign for the industry.”

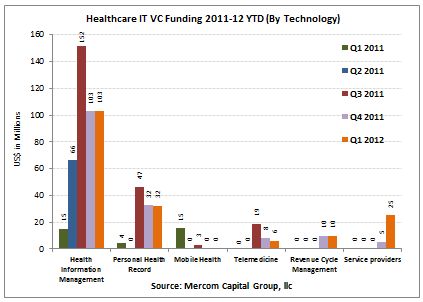

As a technology group, health information management (HIM) companies came out on top with $103 million followed by personal health record (PHR) companies with $32 million. In terms of number of deals, PHR companies had four, business and clinical intelligence companies also had four, clinical decision support companies had three, electronic medical record (EMR) companies had two and electronic health record (EHR) companies also had two.

Top VC funding deals in Q1 included $40 million raised by Kinnser Software, a provider of clinical support software to home health companies, followed by $22 million by Healthx, a provider of online healthcare portals and communication products to insurers, medical providers and employees. Other top deals were $14 million raised by Sharecare, an interactive health and wellness social platform, $12 million raised by DocuTAP, a provider of integrated EMR and practice management solutions, and $10.9 million raised by PerfectServe, a provider of clinical communication services.

M&A activity in the healthcare information technology sector was also strong with 34 M&A transactions, only three disclosing details, amounting to $653 million. HIM companies accounted for most of the transactions totaling 15.

The M&A transactions with disclosed details were Verisk Analytics’ acquisition of MediConnect Global, a provider of proprietary systems to facilitate aggregation and analysis of medical records, for $349 million, Nuance Healthcare’s acquisition of Transcend Services, a provider of transcription and clinical documentation services, for $300 million, and DexCom’s acquisition of SweetSpot Diabetes Care, a cloud-based health data company focused on clinical support software in diabetes, for $4.5 million.

To get a copy of this report, please email us at info@mercomcapital.com