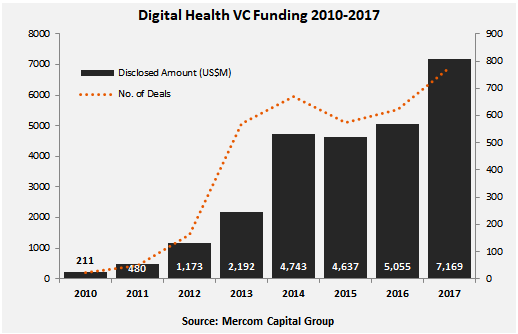

Venture capital (VC) funding, including private equity and corporate venture capital, in Digital Heath globally witnessed a record-breaking year in 2017 with nearly $7.2 billion raised in 778 deals. This was a 42 percent increase from the previous record set in 2016 of $5.1 billion in 622 deals. Total corporate funding for Healthcare IT companies – including debt and public market financing – climbed to $8.2 billion in 2017, a 47 percent increase from the $5.6 billion raised in 2016.

To learn more about the report, visit: https://mercom.wpengine.com/product/2017-q4-annual-healthcare-digital-health-funding-ma-report/

Digital health companies in the United States raised $4.9 billion in 2017 with the remaining $2.3 billion coming from other countries.

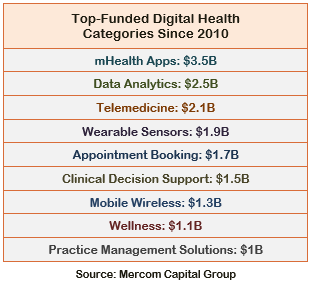

Since 2010, the sector has accumulated $26 billion in VC funding in 3,450 deals and almost $8.6 billion in debt and public market financing (including IPOs), bringing the cumulative funding total for the sector to $34.3 billion.

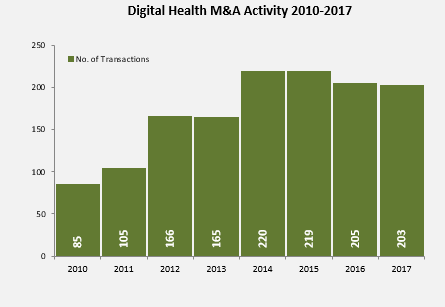

“Venture capital funding into Digital Health spiked after plateauing the last couple of years. Artificial intelligence and Data Analytics companies had a breakout year with over a billion dollars raised. Digital Health public companies had a much better 2016 compared to previous years with a majority of stocks outperforming the S&P 500. However, a buoyant stock market did not translate into companies going public. For the first time in years we did not see any companies issue an IPO in all of 2017. M&A activity, on the other hand, has been declining slightly over the last few years. Investors do not want to miss out on the sheer size and potential of this growing market, but the exit path for many companies remains elusive,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

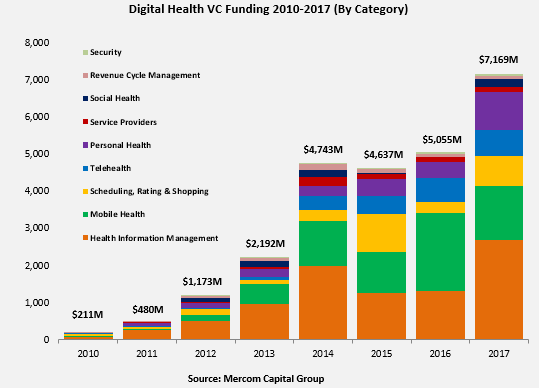

Consumer-centric companies brought in $4.2 billion in 514 deals in 2017, up 21 percent from $3.5 billion raised in 437 deals in 2016. Practice-centric companies raised close to $3 billion in 264 deals in 2017, almost twice the $1.6 billion raised in 185 deals in 2016.

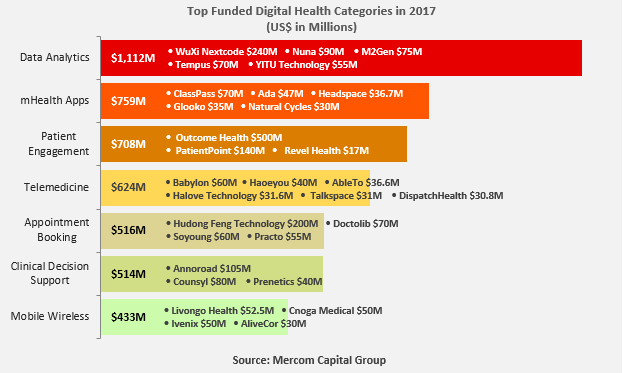

The top funded areas in 2017 included: Data Analytics with $1.1 billion, mHealth Apps with $759 million, Patient Engagement Solutions with $708 million, Telemedicine with $624 million, Appointment Booking with $516 million, and Clinical Decision Support with $514 million.

Categories that saw substantial year-over-year (YoY) funding growth were Data Analytics, Patient Engagement, Clinical Decision Support, and Appointment Booking companies.

For the first time, Data Analytics was the top funded category. The big growth in Data Analytics funding was largely driven by the $419 million that went into Artificial Intelligence-based analytics. Together with predictive analytics, these two categories made up almost $500 million in funding.

mHealth apps and health wearable sensors witnessed steep declines in funding levels year-over-year.

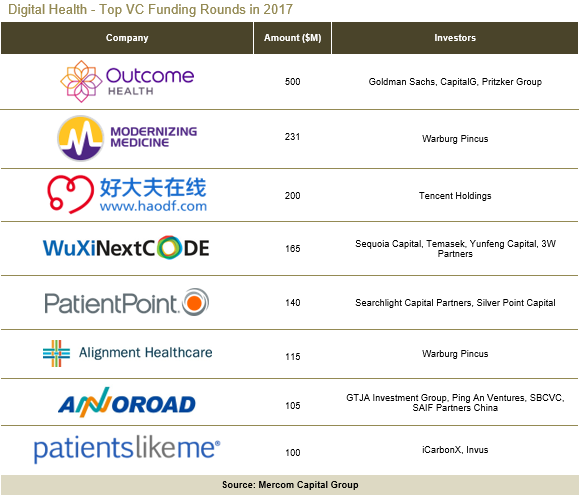

The top VC funding rounds in 2017 raised money for: Outcome Health with $500 million, Modernizing Medicine with $231 million, Hudong Feng Technology with $200 million, WuXi NextCode with $165 million, PatientPoint with $140 million, Alignment Healthcare with $115 million, Annoroad with $105 million, and PatientsLikeMe with $100 million.

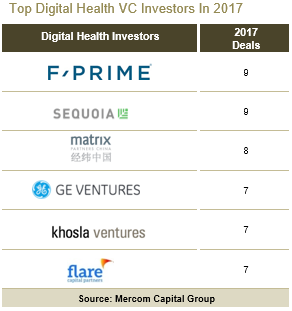

VC investor participation went up in 2017, with the total number of participating investors (including accelerators and incubators) increasing to 1,288 from 1,115 investors in 2016. The most active VC investors in 2017 were F-Prime Capital Partners and Sequoia Capital with nine deals each, followed by Matrix Capital Partners with eight deals, and GE Ventures, Khosla Ventures, and Flare Capital Partners with seven deals each. Accelerator and incubator funding activity slipped to 58 deals in 2017 from 83 deals logged in 2016.

Forty-three countries had Digital Health VC funding deals in 2017 compared to 34 in 2016.

“The largest funding deal in 2017 was the $500 million raised by Outcome Health in Q2, but since then the investors who put in the $500 million have sued to get their money back. The $500 million counted this year in our report may be adjusted in the future if the company has to return the investment. We are also seeing that the definition of Digital Health continues to expand – for example, companies making treadmills with wifi, medicine delivery, and blood tests are being included in the category. This, however, can be misleading and gives a false interpretation of funding trends in the sector,” added Prabhu.

There were 203 M&A transactions in 2017, similar to the 205 transactions in 2016. There were 13 companies that participated in multiple transactions in 2017. Four public companies were also acquired or merged in 2017.

Data Analytics companies were involved in the most M&A transactions in 2017 with 21, followed by Practice Management Solution companies with 19 transactions, mHealth App companies with 17, and Telemedicine companies with 16 transactions.

There were 240 companies that made multiple acquisitions from 2010 to 2017. During the seven-year period, IMS Health acquired 12 companies, CompuGroup Medical AG acquired 11, and iMedX acquired 10 companies. McKesson and Quality Systems acquired nine companies each, while Allscripts, athenahealth, Emdeon, GE Healthcare, Harris Corporation, and Philips acquired eight companies each. PracticeMax acquired seven companies.

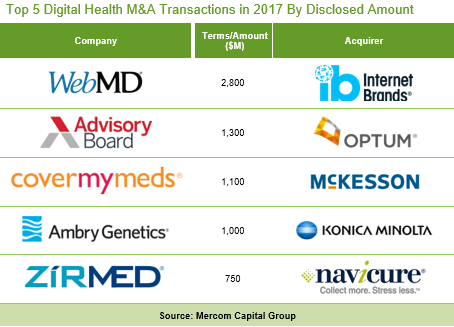

The top five disclosed M&A transactions in 2017 included: Internet Brands’ acquisition of WebMD for $2.8 billion, Optum’s $1.3 billion acquisition of the Advisory Board Company, McKesson’s acquisition of CoverMyMeds for $1.1 billion, Konica Minolta’s acquisition of Ambry Genetics Corporation for $1 billion, and Navicure’s acquisition of ZirMed for ~$750 million.

Announced debt and public market financing raised by Healthcare IT companies nearly doubled to more than $1 billion in 2017 from $533 million raised in 2016 and the total number of transactions likewise jumped to 34 deals from 18 deals in 2016. No IPOs were announced in 2017 whereas there were four IPOs that raised a combined $234 million in 2016.

Of the 26 digital health public companies tracked by Mercom, 14 companies beat the S&P 500 in 2017 compared to just eight outperforming companies in 2016. About 38 percent of public Healthcare IT company stocks were in negative territory in 2017.

To learn more about the report, visit: https://mercom.wpengine.com/product/2017-q4-annual-healthcare-digital-health-funding-ma-report/