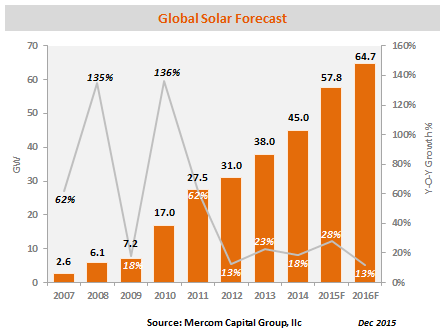

Mercom Capital Group, llc, a global clean energy communications and consulting firm, forecasts another year of solar growth with installations expected to reach 64.7 GW in 2016 up from 57.8 GW forecast for 2015.

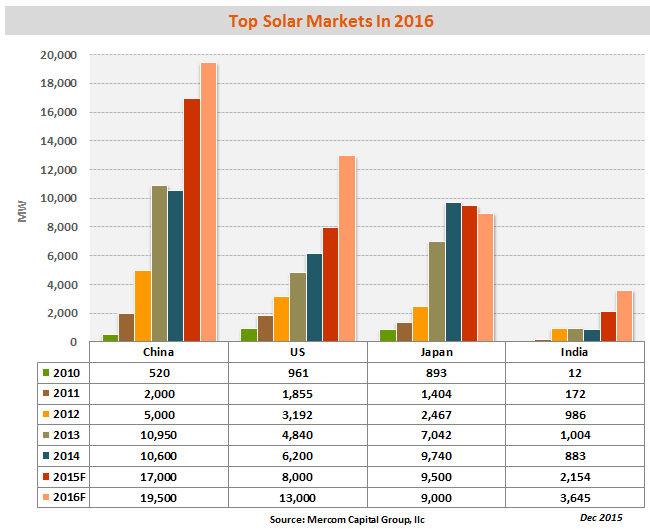

“The largest markets in 2016 will again be China, the United States and Japan; the United States is set to overtake Japan as the second largest solar market behind China. These three countries will account for about 65 percent of installations next year” said Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

China will continue to be the largest solar market in the world, installing approximately 19.5 GW in 2016. China has installed almost 10 GW in the first three quarters this year, well ahead of 3.79 GW installed in the same period last year. Curtailment and delayed subsidy payments remain a challenge. The announcement of an additional 5.3 GW installation quota with a completion deadline of June 2016 for provinces that have met or exceed their installation goals is likely to help China get close to meeting its installation goals in 2015, and ensures a strong 2016. The Chinese government is expected to increase its 2020 installation target to 150-200 GW.

Mercom is forecasting the United States to install about 13 GW of solar next year which will be the best year for U.S. solar installations by far. The U.S. solar market is expected to experience robust growth for the next 13 months as the industry rushes to complete projects before the 30 percent investment tax credit (ITC) drops to 10 percent. The industry is hopeful, but not betting, on a possible extension to 30 percent ITC at 30 percent. The 2016 installation estimates will need to be revised if solar projects are allowed to “begin construction” by December 31, 2016 instead of reaching completion, or if there is an agreement in Congress to extend the ITC in any form.

Japan is expected to install about 9 GW of solar in 2016. The Japanese solar industry has experienced two feed-in tariff (FiT) cuts in 2015 as the government looks to trim solar subsidy costs. So far, Japan has approved a little more than 80 GW of solar projects under its FiT program, of which about 25 percent has been installed. Japan is going through a transformation in the energy sector with a change in its energy mix going into 2030, giving more weight to renewables and cutting back on nuclear energy. Japan also is in the process of deregulating its utilities and breaking up monopolies. Japanese domestic solar module shipments have dropped the last two quarters following the reduction in FiTs.

In European market activity, the U.K. is expected to lead in terms of PV installations in 2016 followed by Germany and France. There is a lot of uncertainty surrounding the U.K. PV market with a decision on FiT cuts still pending and Renewable Energy Credits set to expire in April 2016.

Indian solar installations are expected to reach about 3.6 GW in 2016, significant growth compared to the 2.1 GW forecasted for 2015. Momentum has picked up after the government set a target of 100 GW by 2022. Aggressive bidding in its recent auctions has caused some concerns as to the viability of these projects due to unrealistically low bids. The latest India update can be found here: http://bit.ly/mercomifq4

Subscribers to Mercom’s weekly Solar Market Intelligence Report will have access to the full update. To become a subscriber, visit: https://secure.campaigner.com/CSB/Public/Form.aspx?fid=1120345.