Naked Energy, a provider of solar thermal and solar PVT solutions, secured £17 million (~$22.06 million) in a Series B funding round led by E.ON Energy Infrastructure Solutions (E.ON EIS), a provider of integrated, sustainable energy solutions for cities and industries. The series was supported by co-investment from existing investor Barclays through its Sustainable Impact Capital. The partnership between E.ON and Naked Energy is expected to facilitate the provision of Naked Energy’s technology through a “Heat-As-A-Service” model to a global client base.

Canada-based Brookfield Asset Management has announced an equity investment in Leap Green Energy, a renewable energy company based in Tamil Nadu, India. The initial commitment includes an equity investment of over $200 million, comprising the subscription of new shares and the acquisition of shares from existing shareholders. Under the terms of the definitive strategic investment agreements, Brookfield has acquired a majority controlling stake in Leap Green. This partnership aims to enhance Leap Green’s capabilities and expand the platform’s capacity to over 3 GW within the next four to five years.

Jupiter International, a manufacturer of photovoltaic solar cells and provider of solar power solutions in India, has received an investment of ₹3 billion (~$35.89 million) from ValueQuest S.C.A.L.E. private equity fund. Jupiter aims to establish a 1.8 GW solar cell and 1.2 GW solar module manufacturing facility with this funding. The company has formed a joint venture with AmpIn Energy to develop an integrated solar cell and module capacity of 1.2 GW each

epilot, a software-based smart grid solutions provider, secured €10 million (~$11 million) from Expedition Growth Capital, a London-based venture Capital Firm. The company will use the funding to expand its team. epilot provides software that utilities can use to standardize and automate sales processes for new renewable energy products. According to the company, grid operators can also use the software to reduce bottlenecks in workflows and connect more customers to renewable energy systems at home.

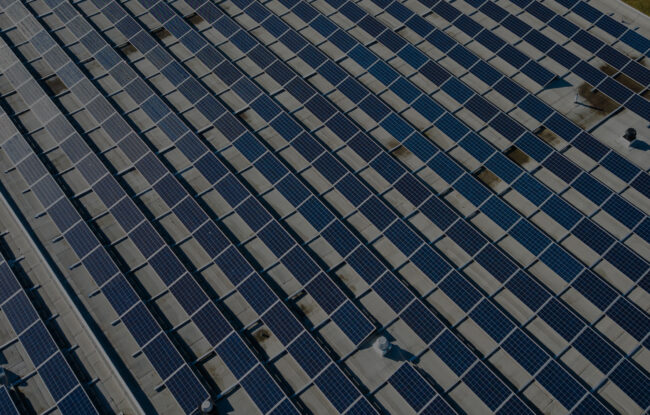

Galileo, a European platform focused on renewable energy development and investment, has announced the acquisition of an additional 65% stake in Pagra, a company specializing in solar PV rooftop installations. Having initially secured a 35% minority stake in July 2022, Galileo now fully owns Pagra, aiming to accelerate the company’s growth strategy.

For reports and trackers on funding and M&A transactions in solar, energy storage, and smart grid sectors, click here.

Read last week’s funding roundup.