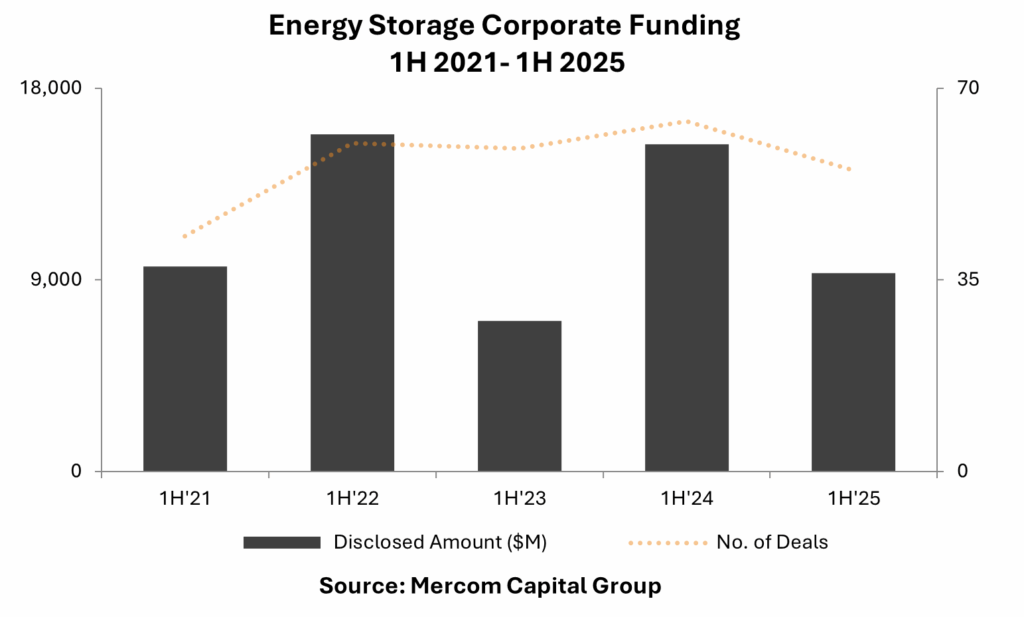

Corporate funding for energy storage companies in 1H 2025 reached $9.1 billion across 55 deals, a 41% decrease year-over-year (YoY) compared to $15.4 billion in 64 deals in 1H 2024, as policy uncertainties and tariff announcements negatively impacted financing activities.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-2025-funding-ma-report-energy-storage/

VC funding for Energy Storage companies in 1H 2025 came to $1.7 billion in 36 deals, a 29% decrease YoY compared to $2.4 billion in 48 deals in 1H 2024.

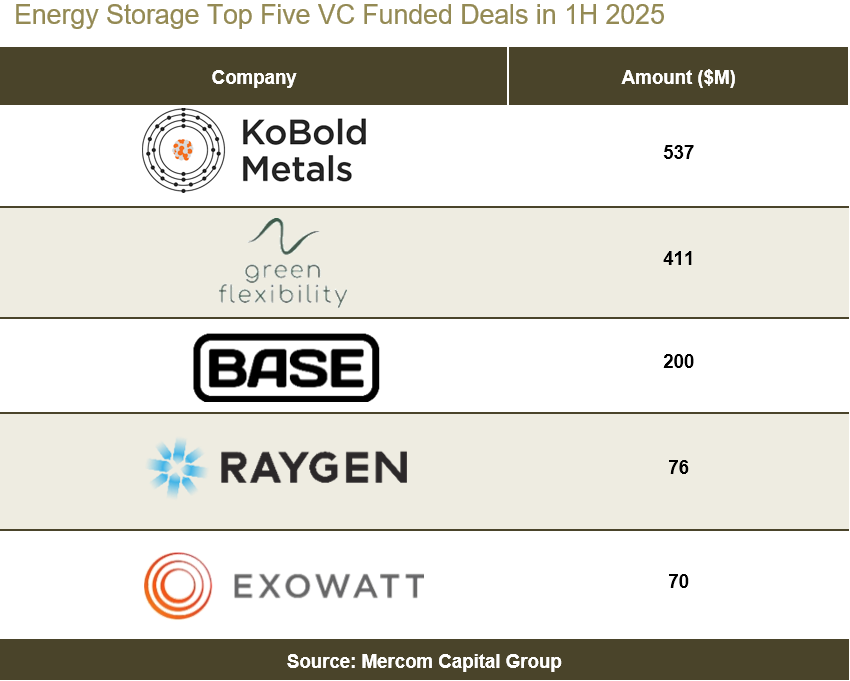

The Top 5 Energy Storage VC funding deals in 1H 2025 were: KoBold Metals, which raised $537 million; green flexibility, which secured $411 million; Base Power, which received $200 million; RayGen Resources, which raised $76 million; and Exowatt, which brought in $70 million.

Energy Storage Downstream companies received the most VC funding in 1H 2025. Other top-funded categories included Materials and Components, Energy Storage Systems, Sodium-based batteries, and Thermal Energy Storage companies.

Announced debt and public market financing for Energy Storage companies in 1H 2025 came to $7.4 billion in 19 deals, a 43% decrease YoY compared to $13 billion in 16 deals in 1H 2024.

In the first half of 2025, there were three M&A transactions in energy storage sector, down from 14 in the first half of 2024.

Meanwhile, the first half of 2025 saw 31 energy storage project M&A transactions, a 138% increase compared to 13 transactions in the same period of 2024.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-2025-funding-ma-report-energy-storage/