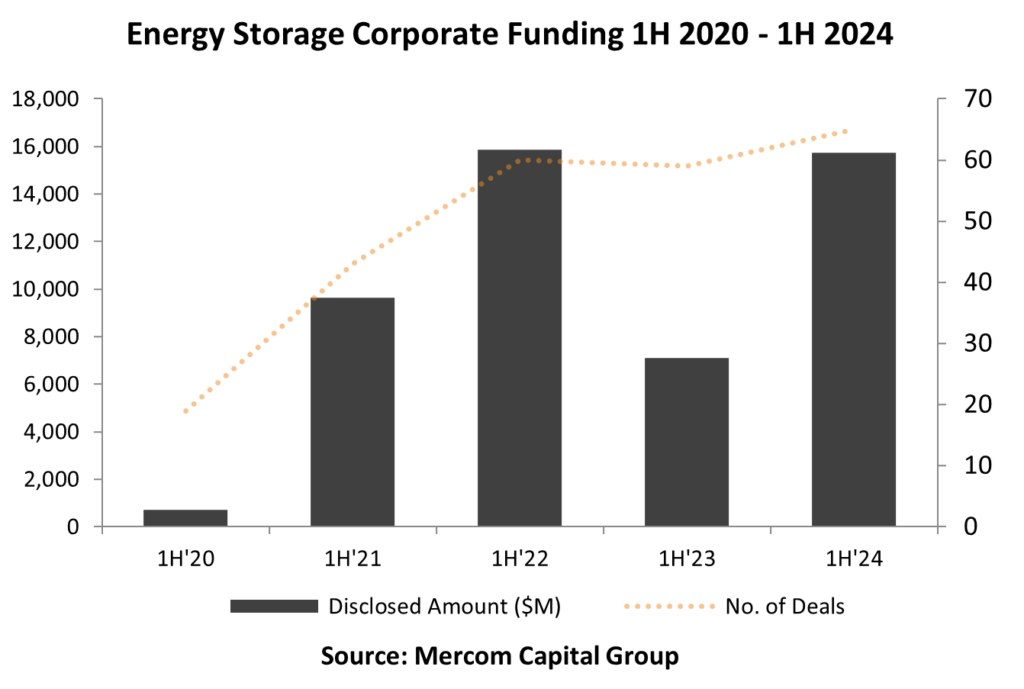

Energy Storage

Corporate funding for energy storage companies in the first half of 2024 reached $15.4 billion across 64 deals, marking a 117% increase year-over-year compared to $7.1 billion in 59 deals in the first half of 2023, driven by a strong first quarter.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2024-funding-ma-report-storage-grid/

VC funding for Energy Storage companies in 1H 2024 came to $2.4 billion in 48 deals, a 37% decrease YoY compared to $3.8 billion in 43 deals in 1H 2023.

The Top 5 Energy Storage VC funding deals in 1H 2024 were; Sila, which raised $375 million; EnerVenue, which brought in $308 million; Natron Energy, which raised $189 million; Ascend Elements, which raised $162 million and, Antora Energy, which raised $150 million.

Lithium-ion-based battery companies received the most VC funding in 1H 2024. Other top funded categories included Battery Recycling, Metal-Hydrogen Batteries, Materials and Components providers, and Sodium-based battery companies.

Announced debt and public market financing for Energy Storage companies in 1H 2024 came to $13 billion in 16 deals, a 294% increase YoY compared to $3.3 billion in 16 deals in 1H 2023.

In the first half of 2024, there were 14 M&A transactions, up from eight in the first half of 2023.

Meanwhile, the first half of 2024 saw 13 energy storage project M&A transactions, down from 19 in the same period of 2023.

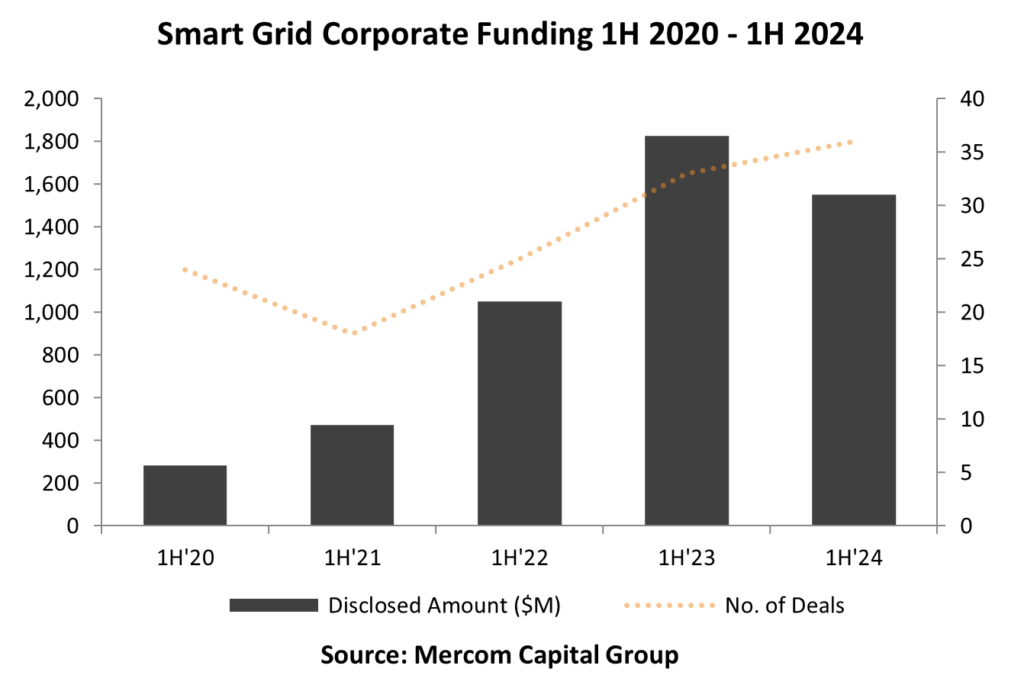

Smart Grid

Corporate funding for Smart Grid companies in 1H 2024 totaled $1.6 billion in 36 deals, 11% lower YoY compared to $1.8 billion raised in 33 deals in 1H 2023.

Boosted by investments in Smart Charging companies, VC funding across all Smart Grid companies in 1H 2024 totaled $1.2 billion in 29 deals, 22% higher YoY than the $986 million raised in 26 deals in 1H 2023.

The Top 5 Smart Grid VC funding deals in 1H 2024 were: Electra, which raised $330 million; Powerdot, which raised $108 million; FLO, which raised $100 million; Monta, which raised $87 million; and Battery Smart, which raised $65 million.

Announced debt and public market financing for Smart Grid technology companies totaled $321 million in seven deals in 1H 2024 compared to $839 million in the same number of deals in 1H 2023.

In 1H 2024, there were three Smart Grid M&A transactions compared to six transactions in 1H 2023.