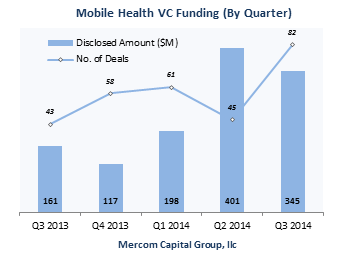

Consumer-focused companies continued to attract VC investors, taking in $623 million in VC funding in 140 deals this quarter. The Mobile Health category captured more than half of these deals with $345 million raised in 82 deals.

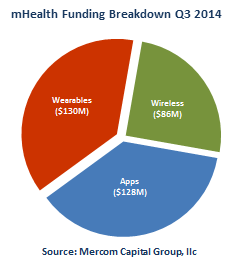

Within the Mobile Health category, Wearables/Sensor technology companies led with $130 million in 21 deals. Devices that received funding were diverse in the Wearables/Sensor technology segment with everything from ingestible sensors, wristbands, skip patches and headbands to clothing. Though the first wave of Wearables/Sensors was primarily focused on fitness tracking activities, they are now being developed to track specific conditions. This quarter saw funding going to companies developing devices that track fitness activity, vitals, sleep patterns, fertility, heart conditions, breathing and lung issues, Alzheimer’s and medication tracking.

To get a copy of this report, please email us at info@mercomcapital.com

Prominent deals in this category included the $52 million raise by Proteus Digital Health, a provider of a digital health feedback system for medication adherence using sensor enabled pills and patches. Propeller Health (formerly Asthmapolis), provider of a mobile platform for respiratory health management, raised $14.5 million. ATHOS, a provider of wearable technology fitness clothing that collects and analyzes muscle activity, effort, heart and breathing rates in real-time, raised $12.2 million. Hello, a developer of the Sense, a sleep tracker that monitors sleep patterns including noise, light, temperature, humidity and particles in the air, raised $10.5 million; Hello also raised $2.4 million in a Kickstarter crowdfunding campaign. Beddit, a provider of a sleep monitoring device that measures resting heart rate, respiratory rate, sleep cycles and time and is associated with an app, raised $8 million, and Beam Technologies, a provider of a smartphone-connected sensor enabled smart toothbrush, received $5 million.

App companies funded this quarter were diverse, but care-focused apps for health practices led with most deals followed by fitness apps, nutrition, communication and diabetes-centered apps. Mobile App companies raised $128 million in 44 deals. Chunyu Yisheng, a Chinese mobile healthcare app company, which connects patients and doctors, raised $50 million. Lmbang, a Chinese mobile application and social networking platform for moms where they can share and communicate the life and growth of their babies, secured $20 million. Netpulse, a data services company and developer of a tracking platform that connects fitness equipment, apps and tracking devices under one platform for fitness equipment companies, secured $18.6 million. Wellframe, a mobile technology company that provides patient engagement and care management applications, raised $8.5 million. Kurbo Health, a developer of mobile apps for weight loss programs, raised $5.8 million. Validic, an API platform that connects personal health data, mobile health apps and devices to the healthcare system and turns it into a single, actionable data stream, raised $5 million.  Mobile Wireless Technology companies received $86 million in 17 deals. Major deals in this category included iHealth Lab (subsidiary of China’s Andon Health), a developer of wireless mobile health devices including a weighing scale, blood pressure monitor, glucometer and pulse oximeter, which raised $25 million. AirStrip, a provider of mobile patient monitoring software that helps physicians monitor live patient data, also raised $25 million. Livongo Health, a provider of cellular-connected blood glucose meters for monitoring diabetes patients and for sharing health data, trends and messages, secured $10 million, and Wearable Intelligence, a developer of Google Glass software for healthcare and energy sectors, raised $7.87 million.

Mobile Wireless Technology companies received $86 million in 17 deals. Major deals in this category included iHealth Lab (subsidiary of China’s Andon Health), a developer of wireless mobile health devices including a weighing scale, blood pressure monitor, glucometer and pulse oximeter, which raised $25 million. AirStrip, a provider of mobile patient monitoring software that helps physicians monitor live patient data, also raised $25 million. Livongo Health, a provider of cellular-connected blood glucose meters for monitoring diabetes patients and for sharing health data, trends and messages, secured $10 million, and Wearable Intelligence, a developer of Google Glass software for healthcare and energy sectors, raised $7.87 million.

To get a copy of this report, please email us at info@mercomcapital.com