Energy Storage

Corporate funding in the energy storage sector was down 31% in 9M 2023, with $15.2 billion raised in 94 deals compared to $22 billion in 93 deals in 9M 2022.

Corporate funding in Energy Storage increased 67% in Q3 2023 with $8.2 billion in 35 deals compared to $4.9 billion in 32 deals in Q2 2023. Funding was up 32% YoY, with $6.2 billion raised in 33 deals in Q3 2022.

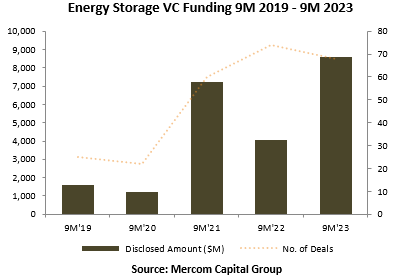

VC funding in Energy Storage in 9M 2023 was up by 115% YoY with $8.6 billion in 68 deals compared to $4 billion in 74 deals in 9M 2022.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-q3-2023-funding-ma-report-storage-grid

Li-based battery companies received the most VC funding in 9M 2023, followed by Battery Recycling companies.

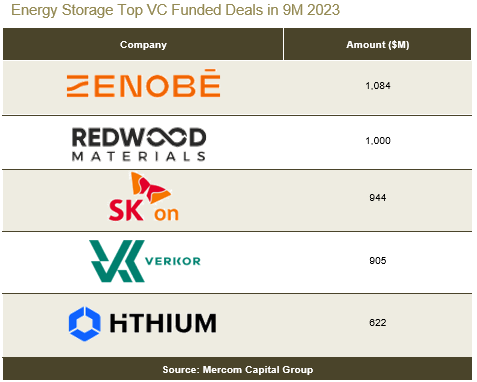

The Top 5 Energy Storage VC funding deals in 9M 2023 were: Zenobe, which raised $1.1 billion; Redwood Materials, which raised $1 billion; SK On, which raised $944 million; Verkor, which raised $905 million; and Hithium, which raised $622 million.

Announced debt and public market financing for Energy Storage companies in 9M 2023 decreased 63% YoY with $6.6 billion in 26 deals compared to $18 billion in 19 deals in 9M 2022. LG Energy Solution’s $10.7 IPO in Q1 and SK On’s $2 billion debt financing in Q3 2022 contributed heavily to the record funding raised in 9M 2022.

In 9M 2023, 11 Energy Storage companies were acquired, compared to 23 in 9M 2022.

Smart Grid

Corporate funding for Smart Grid companies in 9M 2023 was 4% higher YoY, with $2.9 billion in 48 deals compared to $2.8 billion in 35 deals in 9M 2022. Despite significant investments into smart charging companies, VC funding in Q3 2023 decreased 65% quarter-over-quarter (QoQ), with $248 million in 11 deals compared to $706 million in 12 deals in Q2 2023. In a YoY comparison, funding decreased 86% compared to $1.7 billion in 10 deals in Q3 2022.

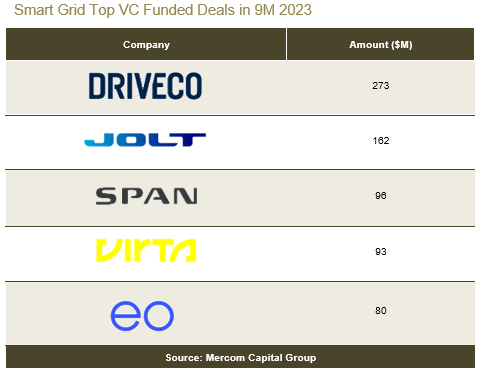

The Top 5 Smart Grid VC funding deals in 9M 2023 were Driveco with $273 million, Jolt Energy with $162 million, SPAN with $96 million, Virta with $93 million, and EO Charging with $80 million.

Announced debt and public market financing for Smart Grid companies in 9M 2023 increased 454% YoY with $1.7 billion in 11 deals compared to $307 million in four deals in 9M 2022.

In 9M 2023, there were eight (8) Smart Grid M&A transactions compared to 18 in 9M 2022.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-q3-2023-funding-ma-report-storage-grid