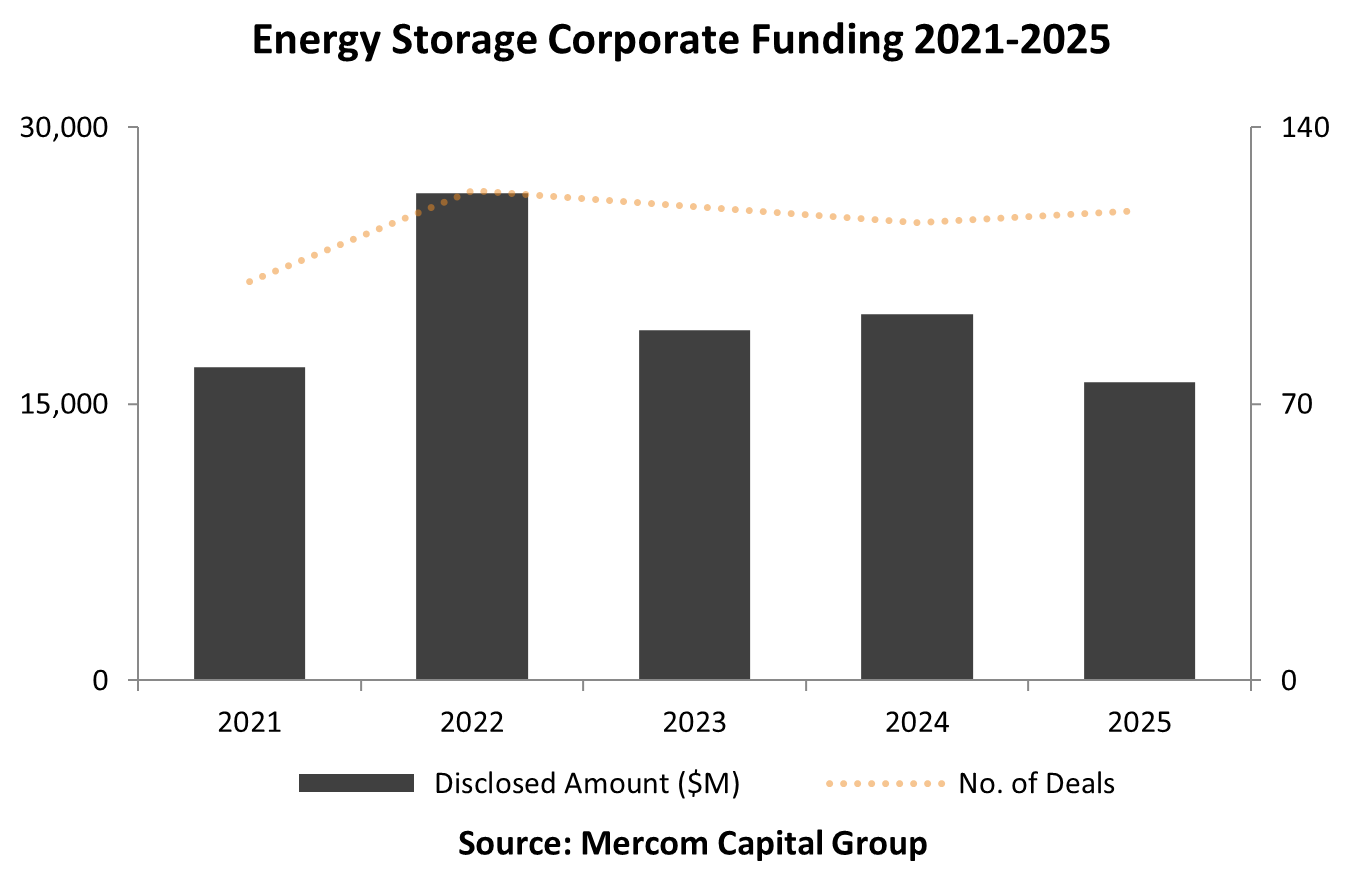

Corporate funding for Energy Storage Companies, including venture capital (VC) funding, debt, and public market financing, reached $16.2 billion in 119 deals in 2025, a 19% decrease year-over-year (YoY) compared to $19.9 billion in 116 deals in 2024, with a 3% YoY increase in deal activity.

To get a copy of the report, visit: https://mercomcapital.com/product/annual-q4-2025-funding-ma-report-storage

Total funding declined despite steady deal activity compared to 2024, which was inflated by a small number of outsized debt deals.

However, VC funding in the Energy Storage sector in 2025 increased 30% YoY, to $4.8 billion across 75 deals, up from $3.7 billion across 84 deals in 2024.

Energy Storage Downstream companies received the most VC funding in 2025. Other top-funded categories included Materials & Components providers, Energy Storage Systems providers, Battery Recycling, and Li-based Battery companies.

“The energy storage market adjusted to a more complex policy and financing environment in 2025. While total funding declined, investment activity remained resilient, with venture capital increasingly directed toward companies aligned with current incentive structures. Energy storage was a clear winner under the OBBB, with the preservation of investment and production tax credits supporting continued investment amid rising power demand from data centers. Project M&A activity also remained strong, reinforcing sustained demand for energy storage assets,” said Raj Prabhu, CEO of Mercom Capital Group.

Top 5 Energy Storage VC funding deals in 2025 were Base Power, which raised $1 billion; KoBold Metals, which raised $537 million; Group14 Technologies, which raised $463 million; green flexibility, which raised $411 million; and Redwood Materials, which raised $350 million.

Announced debt and public market financing for Energy Storage companies in 2025 decreased 30% YoY, with $11.4 billion in 44 deals compared to $16.2 billion in 32 deals in 2024. Despite the lower capital raised, deal activity increased 38% YoY.

Energy storage corporate M&A activity decreased, with 22 companies acquired in 2025 compared to 25 in 2024.

There were 65 project M&A transactions involving energy storage companies announced in 2025, representing a 71% increase compared to 38 transactions in 2024.