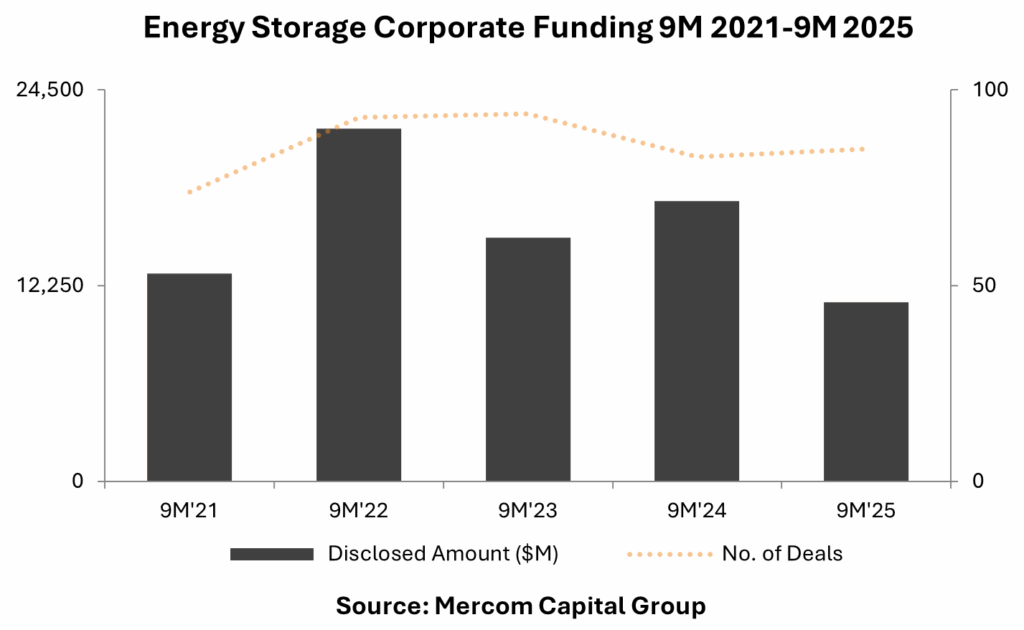

Corporate funding for Energy Storage companies in 9M 2025 reached $11.2 billion in 85 deals, 36% lower year-over-year (YoY) compared to $17.6 billion in 83 deals in 9M 2024.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-and-q3-2025-funding-and-ma-report-for-storage/

Venture capital (VC) funding for Energy Storage companies in 9M 2025 came to $2.8 billion in 56 deals, a 4% increase YoY compared to $2.7 billion in 61 deals in 9M 2024.

Materials and Components providers received the most VC funding ($1.1 billion) in 9M 2025. Other top-funded categories included energy storage downstream companies, energy storage systems providers, lithium-based and sodium-based battery companies.

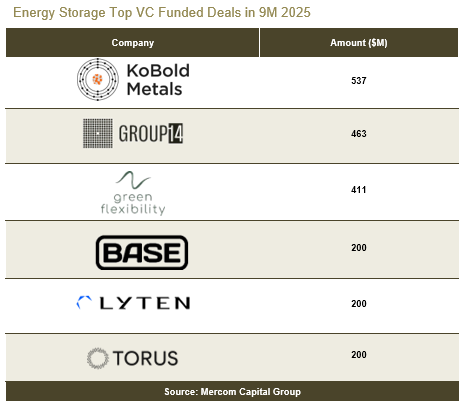

The Top Energy Storage VC funding deals in 9M 2025 were by: KoBold Metals, which raised $537 million; Group14 Technologies, which raised $463 million; green flexibility, which raised $411 million; and Base Power, Lyten, and Torus each raising $200 million.

Announced debt and public market financing for Energy Storage technology companies decreased 44% YoY with $8.4 billion in 29 deals in 9M 2025 compared to $15 billion raised in 22 deals in 9M 2024.

A total of 20 Energy Storage M&A transactions were announced in 9M 2025, up from 18 M&A transactions in 9M 2024.

There were 45 project M&A transactions involving Energy Storage companies announced in 9M 2025 compared to 22 transactions in 9M 2024.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-and-q3-2025-funding-and-ma-report-for-storage/