Total corporate funding (including venture capital funding, public market, and debt financing) for Battery Storage, Smart Grid, and Efficiency companies in 1H 2021 was up exponentially year-over-year (YoY) with $10.4 billion compared to $1.5 billion raised in 1H 2020 when the market was affected by COVID-19.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2021-funding-ma-report-storage-grid-efficiency

Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies come in 468% higher in 1H 2021 with $4.9 billion compared to $858 million in 1H 2020. Investments continue to rise as battery storage companies are poised to play a vital role in the transition from fossil fuels to renewables.

In Q2 2021, VC funding for Battery Storage, Smart Grid, and Efficiency companies increased with $3.6 billion in 28 deals compared to $1.3 billion in 24 deals in Q1 2021. Funding amounts were 493% higher YoY compared to the $605 million raised in 26 deals in Q2 2020. The increase in funding activity was primarily due to a multi-billion dollar deal in the Battery Storage sector this quarter.

Battery Storage

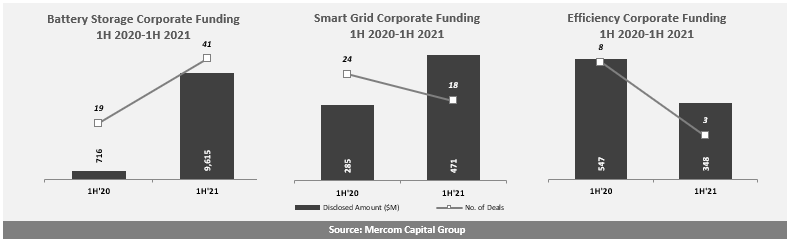

In 1H 2021, $9.6 billion was raised in corporate funding from 41 deals compared to the $716 million raised in 19 deals in 1H 2020. After the corporate funding cratered in Q1 2020 due to the COVID-19 effect, funding levels have improved every quarter since, as the economy and the financial activity bounced back.

VC funding in Battery Storage companies in 1H 2021 was up significantly with $4.4 billion in 33 deals compared to $536 million in 14 deals in 1H 2020. Northvolt’s $2.75 billion funding round in Q2 2021 was a big part of the funding increase.

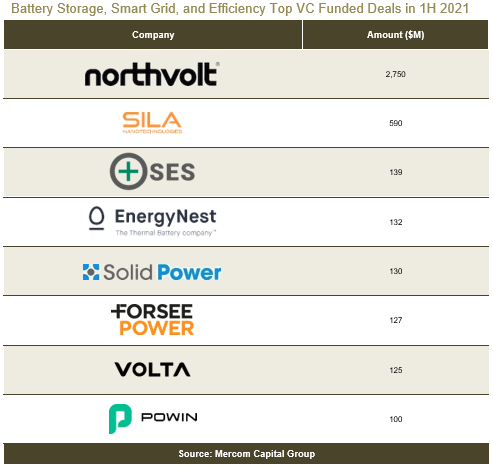

The Top 5 VC funding deals in 1H 2021 were: Northvolt, which raised $2.75 billion, Sila Nanotechnologies, which raised $590 million, SES, which secured $139 million, EnergyNest, which secured $132 million, and Solid Power, which raised $130 million. A total of 106 VC investors participated in Battery Storage funding in 1H 2021.

Announced debt and public market financing activity in the first half of 2021 ($5.2 billion in eight deals) spiked compared to the first half of 2020, when $180 million was raised in five deals.

There were five announced Battery Storage project funding deals in 1H 2021, bringing in a combined $781 million compared to $26 million in five deals in 1H 2020.

In 1H 2021 there were a total of nine (two disclosed) Battery Storage M&A transactions compared to eight transactions (all undisclosed) in 1H 2020.

Smart Grid

VC funding in Smart Grid companies in 1H 2021 was 68% higher with $463 million compared to the $275 million raised in 1H 2020.

In Q2 2021, VC funding for Smart Grid companies decreased with $176 million in seven deals compared to $287 million in 10 deals in Q1 2021. Funding amounts were 9% lower YoY compared to $194 million raised in 14 deals in Q2 2020.

The Top 5 VC funding deals in 1H 2021: Volta Charging raised $125 million; Mainspring Energy raised $95 million, FreeWire Technologies received $50 million, Wallbox raised $40 million, and Voltus raised $31 million.

Announced debt and public market financing for Smart Grid companies came to $8 million in one deal in 1H 2021 compared to $10 million in three deals in 1H 2020.

In 1H 2021, there were a total of 11 Smart Grid M&A transactions (all undisclosed) compared to six transactions (all undisclosed) in 1H 2020.

Efficiency

VC funding for Energy Efficiency companies in 1H 2021 was 89% lower with $5 million compared to the $47 million raised in 1H 2020.

One Energy Efficiency company raised an undisclosed amount of VC funding in Q2 2021 compared to $5 million in one deal in Q1 2021. In a YoY comparison, $40 million was raised in four deals in Q2 2020.

Announced debt and public market financing activity in the first half of 2021 ($343 million in one deal) was 31% lower compared to 1H 2020, when $500 million was raised in one deal.

In 1H 2021 there was one Efficiency M&A transaction ($300 million) compared to one transaction ($1.4 billion) in 1H 2020.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2021-funding-ma-report-storage-grid-efficiency