Connected Energy, a provider of second-life battery energy storage systems, has raised £15 million (~$15.7 million) in funding from Caterpillar Venture Capital, the Hinduja Group, Mercuria, OurCrowd, and Volvo Energy.

Other existing investors, Engie New Ventures, Macquarie, and the Low Carbon Innovation Fund, also participated in the round. The funds help the company scale its operations and move into utility-scale project development.

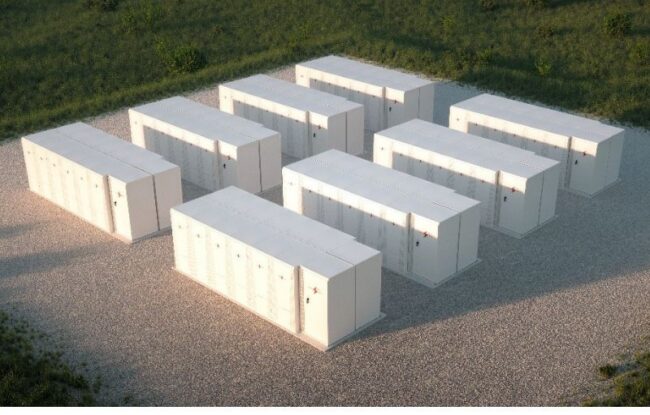

This next funding phase enables Connected Energy to expand its technologies and operations globally and increase its availability of second-life batteries on the international markets. It will also facilitate the in-house development of the company’s first large-scale M-STOR system, which is planned to be around 20 MW and 40 MWh, employing a contracted ‘flow’ of batteries from multiple OEMs to provide long-term operational services to customers.

Electric vehicle (EV) batteries provide about ten years of committed use before their reduced range makes the vehicle impractical.

At this point, if the batteries are recycled, around 40% of the value implanted in the batteries and the associated environmental impact will be wasted. Industry projections suggest that in 2030 around 1 million tonnes of EV batteries could become available for reuse, and by 2035, global requirements for stationary energy storage could be met by 2nd life batteries.

The company currently has sixteen operational systems across Europe in Belgium, Germany, the Netherlands, and the UK, with its largest at Cranfield University in Bedfordshire, England.

“There is a great deal of untapped potential in the second-life use of batteries. This forward-leaning investment aims to facilitate the scaling-up of second-life battery energy storage systems and further secure circular business opportunities for the forthcoming ramp-up in Volvo Group’s second-life battery returns,” said Joachim Rosenberg, President of Volvo Energy.

With an estimated 6.7 million pure EVs operational worldwide and 34.7 million predicted globally by 2030, the potential for battery reuse is vast, as is the need to ensure the resources in the batteries are used effectively. With this investment company aims to scale up its business to utilize a predicted ramp-up in second-life battery availability in 2024/25.

“In order to grow the second-life battery industry, strong pan-value chain relationships will be critical to Connected Energy as it expands, and the company’s new investors will complement this effort. This marks a key gateway for our business. Our group of investors now span battery supply through to project deployment and monetization, and critically this will enable us to plan and manage technology and project development to maximize the volume of batteries that are redeployed in second-life applications,” said Connected Energy CEO Matthew Lumsden.

Turquoise International, UK’s ClimateTech merchant bank, acted as corporate finance adviser to Connected Energy in the fundraising.

According to Mercom’s Q1 2022 Funding and M&A Report for Storage, Grid, and Efficiency, total corporate funding (including VC, Debt, and Public Market Financing) in Battery Energy Storage came to $12.9 billion in 26 deals compared to $4 billion in 27 deals in Q4 2021. Funding was up significantly year-over-year (YoY) compared to $4.7 billion in 18 deals in Q1 2021.