Broad Reach Power, a utility-scale battery storage platform, closed a $160 million project financing for 17 operating battery energy storage systems in Texas and one in California.

Deutsche Bank, New York Branch, and MUFG Bank acted as coordinating lead arrangers and joint bookrunners for the financing. MUFG acted as administrative agent, and Deutsche Bank Trust Company Americas served as a depositary bank and collateral agent.

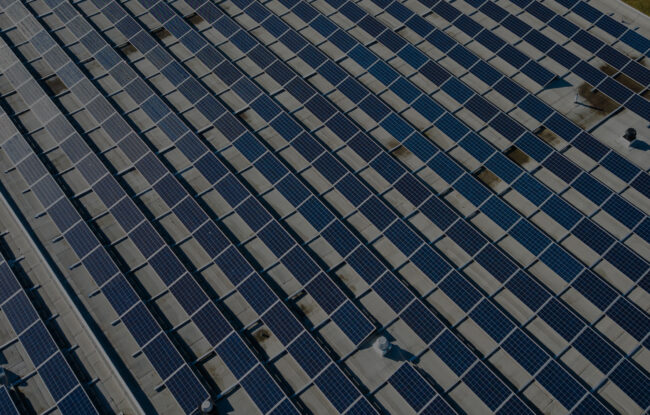

The financed projects are front-of-the-meter, utility-scale assets using lithium-ion technology totaling 390 MWh.

“Battery storage projects are an important pillar in ensuring a reliable and clean electric grid,” said Jeremy Eisman, head of Infrastructure & Energy Financing and Structuring at Deutsche Bank.

“For ERCOT, this portfolio provides significant stability to the grid and balances the intermittent generation of renewables. Broad Reach’s trajectory is exciting, and we’re pleased to be a party to this financing,” said Alex Wernberg, Managing Director, and head of MUFG’s US Power project finance team.

Broad Reach Power is a utility-scale battery storage platform based in Houston, Texas. The Company owns a 21 GW portfolio of utility-scale battery storage and renewable power projects across the U.S., backed by energy transition investors, EnCap Investments, Apollo Global Management, Yorktown Partners, and Mercuria Energy.

Milbank represented Broad Reach Power on this financing transaction, and Paul Hastings represented the lenders.

Earlier this month, Spearmint Energy, a green merchant trading company developing, owning, operating, and trading around Battery Energy Storage, acquired the 150 MW Revolution battery energy storage project from Con Edison Development, a wholly owned subsidiary of Con Edison Clean Energy Businesses. Located adjacent to the King Mountain Wind Farm in the Lower Colorado River Authority Territory, Revolution will provide battery energy storage assets to West Texas’ ERCOT market.

According to Mercom’s 1H and Q2 2022 Funding and M&A Report for Storage, Grid & Efficiency, there were 13 energy storage M&A transactions in 1H 2022 compared to nine in 1H 2021.