As we started putting together a global consensus forecast, traumatic events in Japan and the “wait-and-see” situation in Italy reminded us of just how interconnected our solar markets are and how quickly the world energy landscape can change when events such as a nuclear meltdown changes attitudes across the globe. This could be a turning point for renewable energy as speculation heats up about that the potential for 50-60 gigawatts (GW) of nuclear power capacity being delayed or outright cancelled.

The political impact of this is just unraveling and needs to be watched on a country by country basis. Nowhere was this more true than in Germany, the world’s largest PV market, as it idled seven nuclear reactors which resulting in a jump in forward electricity prices, and Chancellor Angela Merkel’s Conservative Christian Democrats suffering a major electoral defeat. The nuclear situation in Japan and Chancellor Merkel’s reversal on nuclear power plants were directly attributed to the election losses.

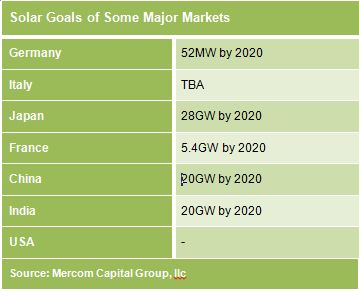

There have been calls from Germany, France, China and other countries to switch to renewable energy faster. China announced that it is looking to double its solar energy goals and more countries are expected to go down this path in the near future.

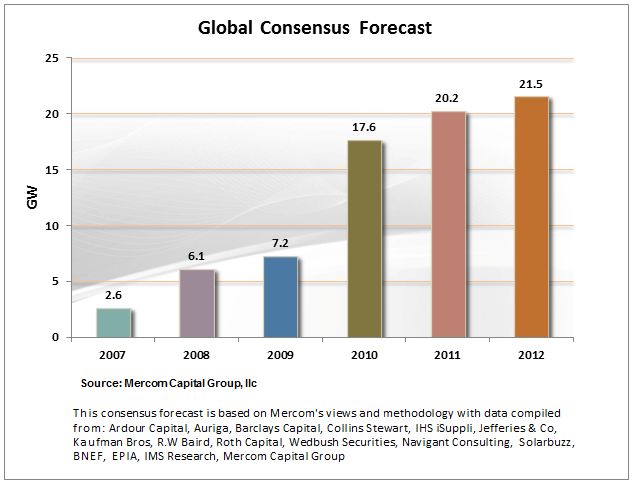

The actual installation numbers for 2010 are still trickling in and by all estimates the markets are forecasted to have grown over 100% in 2010 compared to 2009, making 2010 solar industry’s best ever year.

Following Japan’s earthquake, numerous countries are rethinking their plans about nuclear energy. This has created a high level of uncertainty which may turn out to be a net positive for solar in the long run. This means that forecasting the rest of 2011 and 2012 will be extremely difficult as visibility is extremely low under current political conditions.

Current situation in some major markets:

Germany

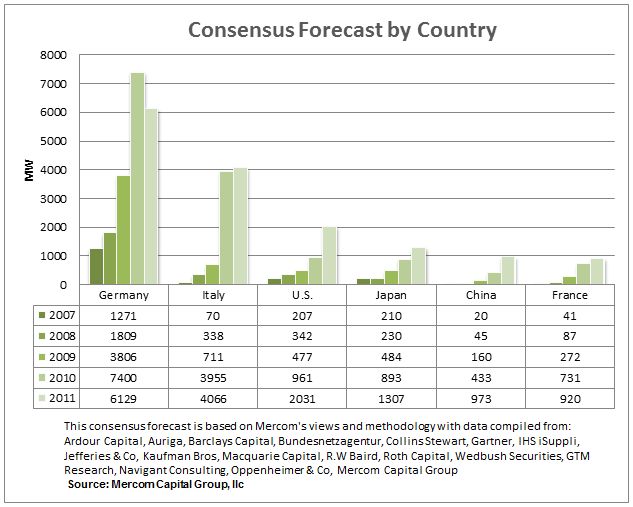

Germany finished 2010 with 7.4GW of installed solar which was lower than earlier estimates. There was a slowdown in the second half of 2010 due to successive cuts in the feed-in-tariff, making returns unattractive to investors. Chancellor Merkel’s reversal on nuclear plants led to the government shutting down seven nuclear plants, affecting an increase in electricity futures prices. This in turn caused the ruling Conservative Christian Democratic Party to lose state elections in the Southwest state of Baden-Wurttemberg, the implications of which will be evident in the near future. There have been calls to move toward renewable energy faster after the nuclear crisis and this may have a positive impact on solar.

Italy

There is still confusion as to the capacity that was installed in Italy in 2010, mainly due to a lag time of 3-4 months between installations and official registrations. One thing most analysts agree on is that installations will far exceed the estimates, mainly fueled by a rich incentive scheme. These very attractive investment returns have caused a “rush” of installation. A revised solar policy will be announced the first week in April (after this article has gone to print) following meetings by the Council of Ministries. Though the outcome is unclear, the goal is to continue the development of solar without an increase in the electricity prices for rate payers.

Regardless of the outcome, it looks as though Italy’s best solar days might be behind it. Italy is currently the second largest solar market in the world, but their uncertain solar policy is having a huge impact on world solar markets. The hunt is on find the next “replacement market(s).”

United States

The United States (US) does not have a FIT system, nor does it have a federally mandated goal for solar. Instead, the market is driven by the federal 30% investment tax credit (ITC), which expires at the end of 2016. This includes a 30% treasury cash grant (which was extended through 2011). Then there are state renewable portfolio standards and state and municipal rebate programs. The development of the US solar market has moved towards large utility-scale projects due to the nature of incentives available. The 30% treasury cash grant is extremely popular and is fueling a lot of growth but it is scheduled to end in 2011 unless congress passes a bill extending it as they did in 2010. Currently, the US is projected to be the top solar market by 2015.

Japan

The tsunami in Japan continues to impact world solar markets in many ways. Nuclear power producing countries have called for a review of nuclear plants before allowing any permits for new nuclear power plants.

Japan is estimated to have grown over 100% year-over-year in 2010 as the government reenergized the solar industry by reintroducing attractive subsidies for residential installation and also by implementing net metering. With the loss of at least six nuclear reactors that produced about 7-8GW of electricity, many are of the opinion that this is a net plus for the solar industry. This point was confirmed this week as the Japanese Minister of Economy announced a raise in preferential tariff for surplus solar power produced by businesses and schools by 67% starting April 1. More of these types of favorable solar policies may be announced by Japan in the near future given the current situation.

China

After the recent events in Japan, China has made an announcement that it will increase its target for solar power from the previous goal of achieving 20GW by 2020. After China announced that it will revise its nuclear plans significantly, there has been speculation that this goal will as much as double. As the largest energy consumer in the world, any move from China towards solar will be a huge boon to the markets.

France

France recently suspended subsidies for solar for a three month period for non-residential installations mainly to limit growth in the sector following a surge in installations in 2010. Solar has come under increased scrutiny as the cost to state utilities is on the rise. The new French framework is designed to achieve its goal of 5.4GW by 2020. A flexible FIT for 20 years has been introduced that changes every quarter according to volumes installed. A reverse FIT (auction) system has been introduced for large rooftop and ground mounted systems where lowest bid wins.

Even with targets to install 500MW in 2011, installations may be much higher because of grandfathering from the previous FIT program.

This consensus forecast includes data from numerous research firms as we wanted to present a combined view which better predicts the movement of the markets with multiple insights and market knowledge. With the world energy markets currently at a turning point, a lot may change in the next three months – we predict that it will be in a positive direction for solar.