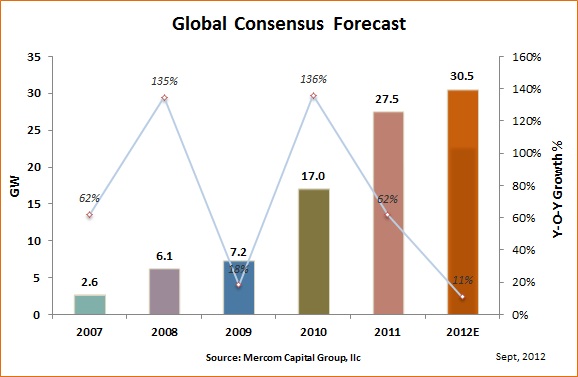

Solar demand continues to defy odds so far in 2012, which may result in another year of growth contrary to pessimistic views early in the year. Module prices continue to fall spurring demand. Tier 1 modules are now in the ~$0.70 range, after falling about 20 percent this year, and about 60 percent since the beginning of 2011. Negative forecasts have turned positive.

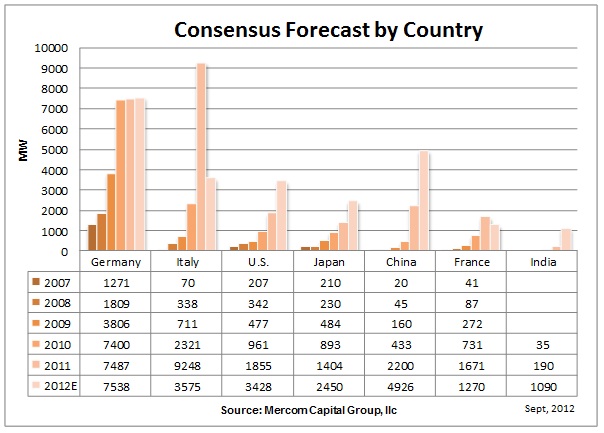

Stubborn European demand, especially from Germany and Italy, is a big reason why the markets are doing well. Germany has already installed about 5 GW as of July, and is on pace to match last year’s 7.5 GW installations number if not exceed it. The delay in implementing Conto Energia V has helped with installations in Italy, which could end the year with around 3.5 GW in installations.

Other markets that could help market growth in 2012 include the United States, China, Japan and India. The United States continues to do well, spurred by state RPOs and solar lease programs, while China set a goal of 21 GW of solar installations by 2015 and is looking to install about 5 GW this year. Japan’s new FiT program is one of the most attractive in the industry and could help drive the country’s large scale solar market which was previously non –existent. India, through its national and state programs, is on pace to install about 1 GW this year.

Recent themes in most markets have been to cut subsidies, as growth around the world has slowed and serious efforts are being made to cut debt.

While the continuous and steep fall in module prices has been the demand driver in most markets, the oversupply of solar panels, especially coming from China at low prices, has resulted in the United States imposing anti-dumping tariffs at about 35 percent on Chinese solar manufacturers, citing unfair export subsidies. The imposed anti-dumping tariffs were much higher than expected, and initial reaction was that it would hurt demand due to higher cost of panels. The European Union (EU) has now followed suit, making things much more serious as EU is a much larger market for Chinese panels than the United States. China is talking about retaliation and all this uncertainty does not bode well for the markets going into 2013.

Germany

The never-say-die German market continues to surprise everyone, and it looks like it may even surpass last year’s record installation of 7.5 GW. Germany has already installed almost 5 GW in the first 7 months of 2012. This is amazing as analysts and experts were forecasting that Germany would only install 2-3.5 GW just six months ago.

After long drawn-out negotiations and delays, the newly reduced FiT program went into effect and will be retroactively effective from April 1, 2012. For installs up to 10 kW capacity, the new FiT will be 19.50 Euro Cents (~$0.26)/kWh, down 20.2%. For installs up to 1 MW capacity, the new FiT will be 16.50 Euro Cents (~$0.22)/kWh, down 24.9%. For installs up to 10 MW capacity, the new FiT will be 13.50 Euro Cents (~$0.18 Cents)/kWh, down 26.4%. A monthly digression will also retroactively take effect from May 1, 2012. Germany will subsidize its solar program up to 52 GW. The goal of this new FiT program is to bring the installation levels to a manageable 2.5-3.5 GW per year, but as long as module prices and system costs keep going down and if investors can make a decent return, installation levels will keep surprising the markets.

Italy

Italy replaced its solar policy, Conto Energia IV, with Conto Energia V, which was passed into law and was supposed to take effect at the end of August; however due to a delay it is now expected to take effect in October. Conto Energia V calls for a €700 million (~$883 million) subsidy cap and also provides a FiT premium for solar panels made in Europe to the tune of ~€20 (~$25)/MWh. The Gestore dei Servizi Energetici (GSE) announced that the annual cost of PV incentives had reached €6B (~$7B) in July, triggering the 45 day notice period for Conto Energia V to kick in at the end of August 2012. However, that date is now postponed until October, creating a “mini rush” situation.

Italy will not get close to its 2011 installation levels, which were over 9 GW. 2012 is expected to finish in the 3.5 GW range.

France

France is one of the first countries in Europe to shift from a feed-in-tariff system to a bidding system for large-scale projects, above 100 kW. France introduced a 500 MW hard cap on annual new installations in 2011. It announced feed-in-tariff cuts yet again in April, which are now about 30 percent lower than a year before, but the tariffs are still very lucrative, for example: 9-36 kW roof-top systems receive $0.42/kWh.

Recent data shows 709 MW were installed in the first half of 2012. France also approved about 540 MW of PV projects recently and plans to call another tender in the next few weeks. The current French market is largely a reflection of grandfathered projects from 2010 coming online – there are about 3.5 GW of grandfathered systems with 2 GW expected to be connected in 2011 and 2012.

United States

The United States installed about 1,800 MW in 2012, almost doubling from 2011, partly fueled by the mini rush caused by the 30% treasury cash grant program expiration at the end of 2011. Significant module price declines of almost 60 percent since the beginning of 2011 and falling system costs have helped spur demand. With state renewable portfolio standards (RPS) driving installations and the increasing popularity of solar leases, demand in 2012 looks strong and could be another banner year for U.S. solar installations.

The United States does not have a central, cohesive solar incentive policy. Instead, the market is driven by state RPSs, state and municipal rebate programs and the 30 percent federal investment tax credit (ITC). California, the largest solar market in the United States, is fueled by an aggressive RPS of 33 percent by 2020. Almost 30 states have some sort of a RPS in place, and about half of them have a solar carve-out. Solar lease programs, where consumers lease instead of upfront investments, are extremely popular–especially in California–and are largely driving the residential market there.

Challenges in the United States market include the uncertainty surrounding the antidumping case where the government imposed anti-dumping tariffs of about 35 percent on Chinese solar manufacturers citing unfair export subsidies. The anti-dumping tariffs imposed were much higher than expected and initial reaction was that it would hurt demand due to higher cost of panels. Chinese companies have a workaround which would reduce the impact by sourcing through Taiwan or Korea as anti-dumping only covers modules manufactured in China and not when sourced from other countries.

China

The National Energy Administration (NEA) in China announced recently that it has hiked its 2015 target for solar power capacity by almost 40% to 21 GW from 15 GW. This sets the pace for Chinese installations in 2012 which could more than double compared to 2011 installations of over 2 GW. The installations in the first half of 2012, according to National Development and Reform Commission (NDRC), was 1.3 GW, which means there has to be a significant pick-up in installations in the second half of 2012.

There is speculation of a new policy announcement in the next few months to support the new 21 GW target. A few possibilities include: long-term FiT with guarantee against retroactive cuts to bring certainty to the markets, a solar RPO in some form targeted towards utilities, and special tax considerations for solar. Some of the current subsidy programs driving the Chinese market are the GoldenSun program, and the 1.00RMB (~$0.16)/kWh FiT.

Some of the challenges in China include an economic slowdown leading to tightening of credit by the state owned banks, significant debt exposure to solar manufacturers have made the banks more cautious when lending to projects, low tariffs, bureaucracy, cumbersome permitting process and transmission bottlenecks which could push the policy towards favoring distributed solar projects in the future.

Japan

Japan has been struggling with power shortages since the Fukushima disaster and has set a goal of achieving 28 GW of cumulative PV by 2020. The Ministry of Economy, Trade, and Industry (METI) announced a much-anticipated feed-in-tariff program in June valid for 20 years. The FiT is very attractive, with PV systems below 10 kW receiving ¥42/kWh (~$0.53) and systems above 10 kW receiving ¥40 (~$0.51). For systems less than 10 kW, the government will purchase only the excess power produced for a period of 10 years, for systems larger than 10 kW the government will purchase all of the power produced. The new FiT program is designed to stimulate new large-scale power projects as there was no FiT available for projects 500 kW or higher previously.

The new FiT is widely expected to kick-start PV installations in a big way, though we have to be wary when the incentives are too generous which usually lead to boom-bust cycles as witnessed in many markets. Japan, with the new program, joins China and India as the markets of the future as European subsidies and demand slows.

India

Indian solar installations are driven by the Jawaharlal Nehru National Solar Mission (JNNSM) with a goal to install 20 GW of solar power by 2022, various state policies and state RPO’s. India has already installed about 825 MW this year and is on pace to install over 1 GW in 2012.

JNNSM and most states use a reverse auction process to select projects while the state of Gujarat (which has the most installations of any India state so far) has a FiT policy in place. India went quickly from almost no installations three years ago to one GW this year and is one of the most promising future solar markets along with China and Japan.

This consensus forecast is based on Mercom’s views and methodology with data compiled from: Auerbach Grayson, Auriga, Barclays Capital, BNEF, Citi, Collins Stewart, Credit Suisse, Daiwa, Deutsche Bank, EPIA, Goldman Sachs, GTM Research, HSBC, ICBC China, IDC Energy Insights, IHS iSuppli, IMS Research, Jefferies, JP Morgan, Kaufman Bros, Macquarie Capital, Mercom Capital Group, Piper Jaffray, R.W Baird, Solarbuzz, Stifel Nicolaus, UBS, Wedbush Securities and other government, public and private sources.