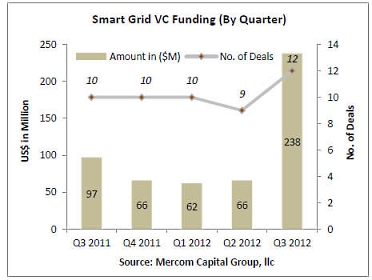

Smart grid venture capital (VC) funding showed some signs of life in Q3 2012 with $238 million in 12 deals. The rise in funding was mostly due to $136 million raised by Alarm.com, a security and home automation company. VC funding in the last three quarters had been relatively weak (Q4 2011 – $66M in 10 deals, Q1 2012 – $62M in 10 deals, Q2 2012 – $66M in 9 deals), whereas VC funding even without the Alarm.com transaction exceeded $100 million this quarter.

“The Alarm.com funding deal and the acquisition of Vivint for $2.2 billion by Blackstone Group is part of a growing trend where home security companies have expanded into home automation,” said Raj Prabhu, Managing Partner at Mercom Capital Group. “We expect to see more transactions in this niche where security, cable and telecom companies expand their offerings to cover the whole ‘connected or digital’ home services which would include everything from communication and automation services to solar installations.”

Apart from Vivint and Alarm.com, other companies in the home security/home automation business that were involved in funding and M&A deals in the last few years include AlertMe, Intamax Systems, Control4, iControl Networks, Home Automation, APX Alarm and Xanboo.

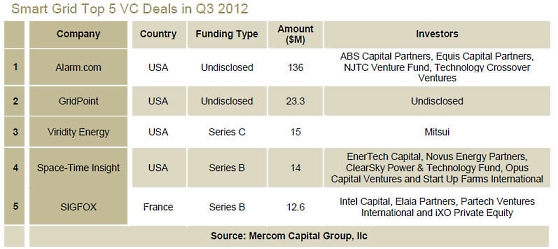

Top five deals this quarter included $136 million raised by Alarm.com from ABS Capital Partners, Equis Capital Partners, NJTC Venture Fund, and Technology Crossover Ventures; GridPoint, an energy management company raised $23.3 million (investors undisclosed); Viridity Energy, a demand side management solutions company, raised $15 million from Mitsui; Space-Time Insight, a geospatial information systems company, raised $14 million from EnerTech Capital, Novus Energy Partners, ClearSky Power & Technology Fund, Opus Capital Ventures and Start Up Farms International; and SIGFOX, a wireless connectivity solutions provider for smart metering, building intelligence and M2M among other markets using ultra narrow band technology, raised $12.6 million from Intel Capital, Elaia Partners, Partech Ventures International and iXO Private Equity.

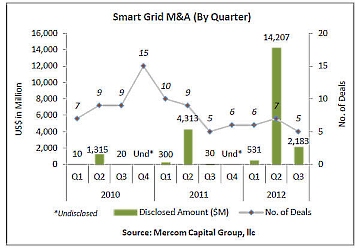

Merger & Acquisition (M&A) activity in Q3 2012 totaled $2.2 billion in five transactions. Top M&A transactions were the $2 billion acquisition of Vivint, a home automation services company, by Blackstone, and the $183 million acquisition of smart grid and automation solutions provider ZIV Group by electrical transmission and distribution equipment company Crompton Greaves.

“We will also be watching for strategic M&As in this area as companies look to add service and technologies needed to compete,” added Prabhu.

To get a copy of this report, please email us at info@mercomcapital.com.