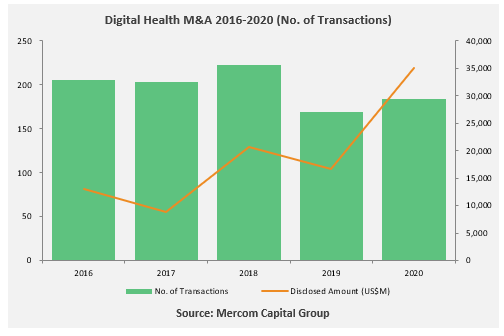

A total of 184 digital health companies were acquired in 2020, compared to 169 in 2019, a 9% increase in M&A activity in year-over-year, according to Mercom’s Q4 and 2020 Digital Health Funding and M&A Report.

Practice management solution companies led M&A activity with 25 transactions, followed by telemedicine companies with 23 transactions, mHealth app companies with 19 transactions, and data analytics companies with 18 transactions.

Eighteen digital health companies made multiple acquisitions during 2020. The most active acquirer was WELL Health Technologies, which acquired five digital health companies, Adracare, INSIG Corporation, DoctorCare, Circle Medical, and Indivica. Sharecare acquired three digital health companies – WhiteHatAI, MindSciences, and Visualize Health. And another 16 companies made two acquisitions each.

Top 5 M&A transactions (by disclosed amount) during 2020:

- In one of the largest digital health M&A transactions ever, Telehealth provider Teladoc Health has agreed to acquire Livongo Health, a developer of cellular-connected blood glucose meter and app for diabetes management, the deal valued at $18.5 billion. Livongo Health raised over $230 million in VC funding. Investors include General Catalyst, Kinnevik, Kleiner Perkins Caufield & Byers, Microsoft Ventures, and Echo Health Ventures.

- Blackstone, a private equity firm, agreed to acquire a majority stake in genetic analysis company Ancestry for $4.7 billion. Ancestry helps customers discover their family history and gain actionable insights about health and wellness. In one of the largest deals, In 2011, Blackstone acquiredEmdeon, a healthcare revenue cycle and payment management platform, for $3 billion.

- Philips, a health technology company, agreed to acquire BioTelemetry, a provider of a wearable cardiac monitoring patch and connected glucose monitors, for $2.8 billion. To date, Philips acquired 16 digital health companies, including Medumo, Direct Radiology, Carestream Health, and Xhale Assurance.

- Invitae, a genetic testing company, acquired ArcherDX, a genomics analysis company, for $1.4 billion. Last year, Invitae acquired Clear Genetics, a patient-centric software provider to integrate genetics into routine patient care, for approximately $50 million.

- Allscripts agreed to sell its CarePort Health business to WellSky (an online healthcare practice management platform) for $1.35 billion.

To date, Allscripts has acquired 17 digital health companies focused on practice management solutions and electronic medical records. In 2018, Allscripts acquired Practice Fusion, a cloud-based electronic health records software developer, for $100 million.

According to the Mercom digital health M&A database, almost 2,000 digital health companies have been acquired/merged since 2010. Learn more.