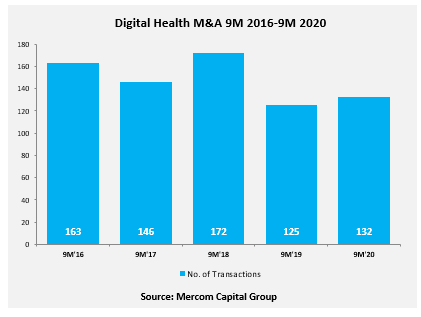

Mergers and acquisitions (M&A) continue to be the most popular source of exit for digital health investors and companies. One hundred and thirty-two digital health companies were acquired in the first nine months (9M) of 2020, compared to 125 in 9M 2019, according to Mercom’s 9M 2020 Digital Health Funding and M&A Report.

Of 132 acquisitions during 9M, 93 were transacted in the U.S., followed by Canada and the U.K., with 14 and six, respectively.

Most acquired categories in 9M 2020 included Practice Management Solutions with 15, closely followed by Data Analytics, mHealth Apps, and Telemedicine, with 14 transactions each. Wearable Sensors and Wellness companies were each involved in six M&A transactions during 9M.

Forty-nine digital health companies acquired in Q3 2020, compared to 42 companies in Q2 2020.

Top M&As during 9M 2020:

- In one of the largest digital health M&A transactions ever, Telehealth provider Teladoc Health has agreed to acquire Livongo Health, a developer of cellular-connected blood glucose meter and app for diabetes management, the deal valued at $18.5 billion.

- Blackstone, a private equity firm, agreed to acquire a majority stake in genetic analysis company Ancestry for $4.7 billion. Ancestry helps customers discover their family history and gain actionable insights about health and wellness.

- Invitae, a genetic testing company, acquired ArcherDX, a genomics analysis company, for $1.4 billion.

- Specialists On Call (dba SOC Telemed), a telemedicine technology provider, agreed to be acquired and taken public by Healthcare Merger Corporation, a special purpose acquisition company, for an initial enterprise value of approximately $720 million.

- Teladoc Health, a telemedicine company, agreed to acquire InTouch Health, a telehealth solution provider for hospitals and health systems, for $600 million.

According to the Mercom database, almost 2,000 digital health companies have been involved in M&A transactions since 2010. Learn more.