Venture capital (VC) funding and M&A activity were strong in 2011, setting records for number of deals and M&A activity.

“Investment activity in 2011 was robust,” said Raj Prabhu, managing partner of Mercom. “Whether you point to the dramatic module price declines, Europe’s diminishing incentives, or the so-called ‘Solyndra effect’, solar continued to gain attention and dollars for technology and innovation through venture capital funding.”

Notable findings include:

- VC investment in solar totaled $1.9 billion in 111 deals in 2011—the highest number of deals ever in a single year. By comparison, there were 65 VC deals in 2010, 84 in 2009, 93 in 2008, and 71 in 2007.

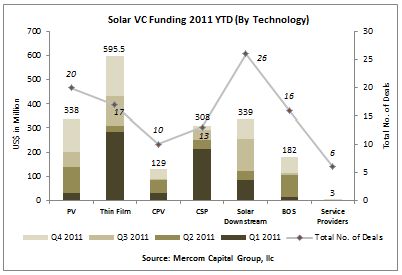

- Thin-film technology raised the most VC funding ($595.5 million in 17 deals), beating downstream companies ($339 million in 26 deals), crystalline-silicon ($338 million in 20 deals), concentrated solar power ($308 million in 13 deals), and concentrated PV ($129 million in 10 deals).

- The solar thermal power company BrightSource Energy raised $201 million in Series E funding, making it the largest single VC investment of 2011. Stion, a manufacturer of high-efficiency thin-film solar modules, came in second when it announced $130 million. The third and fourth highest VC fundraising rounds were by thin-film solar panel maker MiaSolé ($106 million, Series F), and solar cell developer Suniva ($94.4 million, Series D) respectively.

- The top VC investor of 2011 was Kleiner Perkins Caufield & Byers, which completed eight transactions, followed by GE and Good Energies, with six transactions each. There were 182 VC investors in solar in 2011.

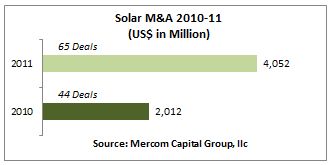

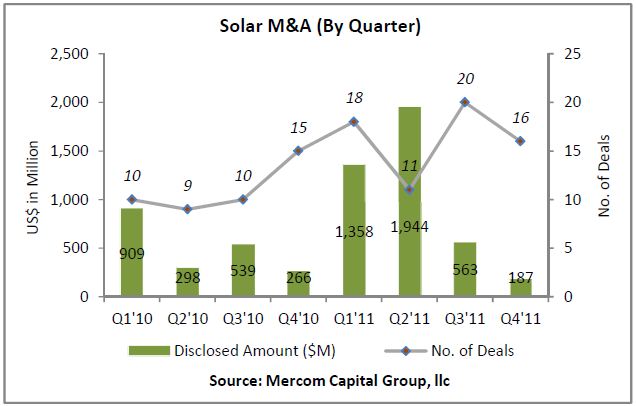

- M&A activity in 2011 was more than double that of 2010 in terms of dollars, and approximately 33 percent more in deals. There were $4 billion in M&A activity in 65 deals, compared to just over $2 billion in 44 deals in 2010. The largest single M&A transaction was Total’s (the French oil & gas company

) 60 percent stake in the solar manufacturer SunPower, accounting for $1.4 billion of the $4 billion. - While Solyndra dominated headlines in the United States and globally, over $700 million worth of VC investment came after the solar manufacturer’s bankruptcy announcement on August 31, 2011.

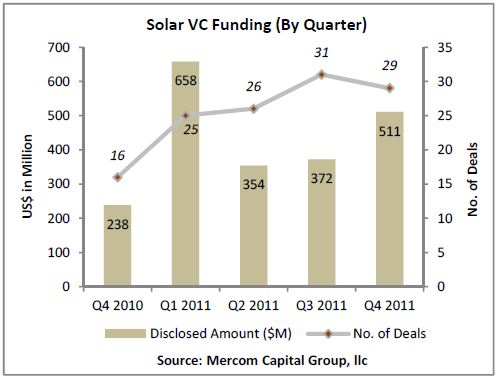

- Fourth quarter VC funding totaled $511 million, compared to $372 million in Q3, $354 million in Q2, and $658 million in Q1.

“Falling panel prices and oversupply brought about a lot of consolidation activity,” added Prabhu. “With valuations of publicly-traded solar companies at record lows, M&A was the go-to exit strategy.”

“Falling panel prices and oversupply brought about a lot of consolidation activity,” added Prabhu. “With valuations of publicly-traded solar companies at record lows, M&A was the go-to exit strategy.”

The United States led all other countries in number of deals and VC funding, with 84 deals and over $1.5 billion of investments. The United Kingdom completed the second highest number of deals with five, and India garnered the second highest amount of VC funding with $95 million.

Globally, debt financing totaled $20 billion. The top debt investor was the China Development Bank. Chinese loans, credit facilities and framework agreements came to $15.7 billion in ten transactions.

Mercom Capital Group’s report also includes information on project-specific funding, U.S. Department of Energy Loan Guarantee awards, new funds, restructuring and bankruptcies.

- To get a copy of this report, please email us at info@mercomcapital.com.