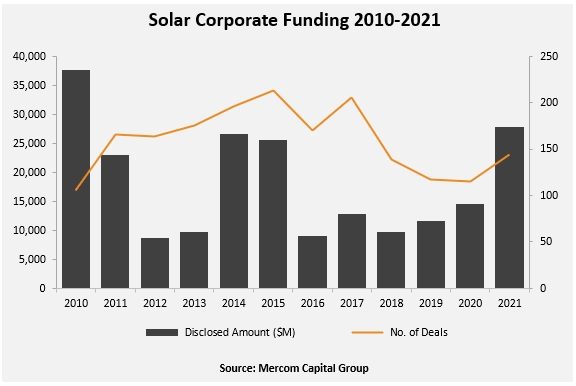

Total corporate funding across the globe in the solar sector, including venture capital and private equity (VC), debt financing, and public market financing, came to $27.8 billion, a 91% increase compared to the $14.5 billion raised in 2020. Corporate funding in 2021 was the highest in ten years.

To learn more about Mercom’s 2021 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/annual-q4-2021-solar-funding-ma-report

“2021 was the best year for solar corporate funding as well as mergers and acquisitions since 2010. Financing activity bounced back strongly following a COVID-19-affected 2020. There was more money than ever chasing deals and more demand than supply of attractive companies and assets as organizations and funds look to fulfill their ESG and clean energy mandates,” said Raj Prabhu, CEO of Mercom Capital Group.

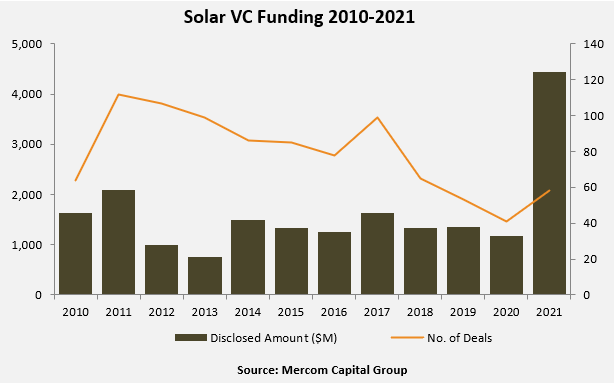

Global venture capital and private equity funding in the solar sector in 2021 came to $4.5 billion, a 281% increase compared to the $1.2 billion in 2020. This is the highest amount of VC funding for the solar sector since 2010. There were 11 VC funding deals of over $100 million apiece in 2021.

Of the $4.5 billion in VC funding raised in 58 deals in 2021, $3.9 billion (89%) went to 43 Solar Downstream companies. Balance of System companies raised $219 million; Concentrated Solar Power companies bought in $108 million; Solar PV companies raised $91 million; Solar Service Providers raised $35 million; and Thin-Film technology companies raised $18 million.

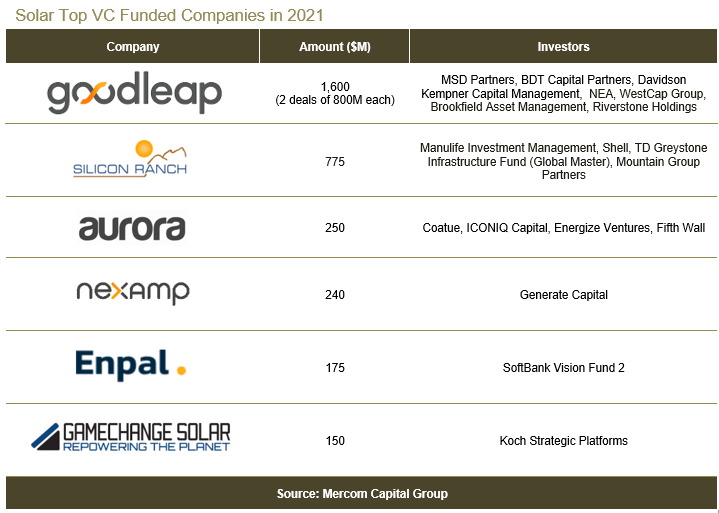

The top VC funded companies in 2021 were GoodLeap (formerly Loanpal), a residential solar loan provider, which raised $1.6 billion in two separate transactions of $800 million each, followed by Silicon Ranch Corporation, which brought in $775 million, Aurora Solar, which raised $250 million, Nexamp, with $240 million, Enpal with $175 million, and GameChange Solar, which raised $150 million.

There were 154 VC and PE investors that participated in funding deals in 2021, with seven involved in multiple rounds.

Public market financing in 2021 totaled $7.5 billion, which was 49% higher compared to $5.1 billion in 2020. The largest deal was by Shoals Technologies Group, a provider of BOS components for solar projects, which raised $2.2 billion through its IPO. Ten solar companies went public through IPOs and SPACs in 2021.

In 2021, announced debt financing came to $15.8 billion, a 91% increase compared to $8.3 billion raised during 2020. Record securitization activity was a key contributor to the rise in debt financing activity during 2021, with $3.7 billion in 13 deals.

M&A activity in the solar sector soared with 126 transactions in 2021 – the highest number of deals ever recorded. Most of the transactions involved Solar Downstream companies. The largest transaction in 2021 was Adani Green Energy Limited (AGEL), which acquired a 100% stake in SB Energy India at an enterprise valuation of approximately $3.5 billion.

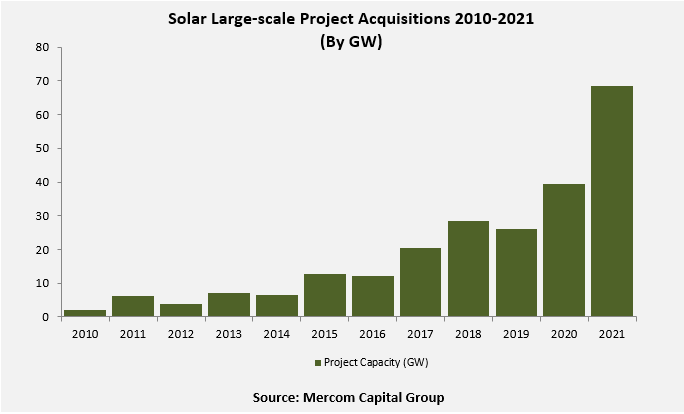

There were 280 large-scale solar project acquisitions in 2021 compared to 231 transactions in 2020. In 2021, the sector also saw the most project acquisition activity in terms of gigawatts, with more than 69 GW changing hands compared to 40 GW in 2020.

367 companies and investors are covered in this 131-page report, which contains 108 charts, graphs, and tables.

367 companies and investors are covered in this 131-page report, which contains 108 charts, graphs, and tables.

To learn more about Mercom’s 2021 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/annual-q4-2021-solar-funding-ma-report.