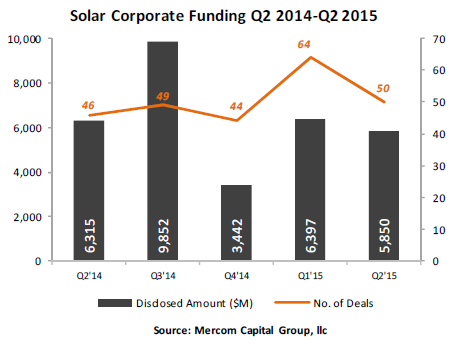

Total global corporate funding in the solar sector, including venture capital/private equity (VC), debt financing, and public market financing raised by public companies, decreased to $5.9 billion, compared to $6.4 billion in Q1 2015.

Raj Prabhu, CEO of Mercom Capital Group, commented, “Overall corporate funding was down slightly this quarter. Yieldcos had a significant impact on the financial activity in the sector and raised $1.6 billion in public markets, about $800 million in debt, and accounted for almost a third of all large-scale project acquisitions. Residential and commercial solar funds continue to attract record funding as the ITC expiration deadline approaches.”

VC funding dipped to $142 million in 24 deals, compared to $195 million in 27 deals in Q1 2015. Solar downstream companies continued to attract most of the VC funding with $60 million in 13 deals.

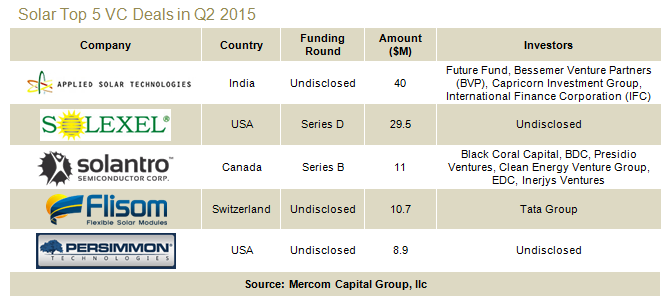

Among the Top 5 VC deals in Q2 2015, the largest was the $40 million raised by Applied Solar Technologies, an off-grid solar energy service provider based in India, from Future Fund, Bessemer Venture Partners, Capricorn Investment Group and International Finance Corporation. Solexel, a manufacturer of crystalline-silicon solar cells and modules, raised $29.5 million. Solantro Semiconductor, a developer of chipsets and reference designs for module integrated electronics within distributed solar PV solutions, raised $11 million from Black Coral Capital, Business Development Bank of Canada, Presidio Ventures, Clean Energy Venture Group, Export Development Canada and Inerjys Ventures. Flisom, a Swiss developer of manufacturing technologies for the production of flexible solar modules based on CIGS thin-film technology, raised $10.7 million from the Tata Group. Persimmon Technologies, a technology company that develops, manufactures and distributes robotics and automation systems used in semiconductor, solar, LED, and flat panel display equipment, raised $8.9 million.

A total of 28 VCs invested in Q2 2015, with Clean Energy Venture Group participating in two deals.

Public market financing was a record $2.3 billion this quarter compared to $1.3 billion in Q1 2015. The largest deals this quarter (excluding IPOs) were the $670 million raised by Abengoa Yield through private placement of shares, $408 million raised by Risen Energy, a Chinese solar PV manufacturer, and the $335 million raised by SunEdison, through its TerraForm Global Yieldco. There was one IPO this quarter: 8point3 Energy Partners, a yieldco company formed by First Solar and SunPower to own, operate and acquire solar energy generation projects, raised $420 million and listed on NASDAQ Global Select Market.

Debt financing fell this quarter to $3.4 billion, compared to $5 billion in Q1 2015. The top deal was the $1.3 billion loan secured by GCL New Energy, a Chinese solar project developer and investor, from China Merchants Bank, Nanjing Branch.

Announced large-scale project funding came to $1.9 billion in 26 deals, compared to $2.5 billion in 29 deals in Q1 2015. The Top 5 large-scale project funding deals included the $355 million raised by GE Energy Financial Services in a partnership with Pacifico Energy, for the development of a 96.2 MW solar PV project in Hosoe, Kyushi Island, Miyazaki prefecture, Japan. GE Energy Financial Services brought in $62.7 million in equity and secured a $292 million loan from a syndicate of 12 Japanese financial institutions led by The Bank of Tokyo Mitsubishi UFJ. sPower, an independent power producer, received a $168.5 million loan from KeyBank National Association, OneWest Bank and Zions Bank for 25 solar assets, totaling 144 MW in three separate portfolios. Low Carbon, a renewable energy developer, operator and investor, secured $163.5 million in refinancing from Macquarie Infrastructure Debt Investment Solutions for part of its existing portfolio of twelve operational solar projects with a cumulative capacity of 99.2 MW in the United Kingdom. Kong Sun Holdings Company received a $163 million finance lease credit line from Jiangsu Solarbao Leasing, a wholly-owned subsidiary of SPI Solar, for its PV projects in China. ONEE, Morocco’s state-owned electricity and water company, received a $149 million loan for three solar PV projects with a total capacity of 75 MW. The projects are co-financed by a $125 million World Bank loan and a $23.95 million loan from the Clean Technology Fund.

Residential and commercial solar funds raised $1.93 billion in five deals, similar to the $1.92 billion raised in 10 deals last quarter, and the highest quarter to date. Of this total, $775 million went to three loan funds and $1.2 billion went to two third-party lease or PPA funds. SolarCity announced $1.5 billion in two separate deals.

There were 17 corporate M&A transactions in the solar sector this quarter, compared to 29 transactions in Q1 2015. Solar downstream companies accounted for 10 of these M&A transactions.

The largest disclosed M&A transaction was the acquisition of RBI Solar, Rough Brothers Manufacturing, and affiliates (collectively RBI) for $130 million by Gibraltar Industries. RBI Solar is engaged in the design, engineering, manufacturing and installation of solar mounting systems for commercial and utility-scale solar projects.

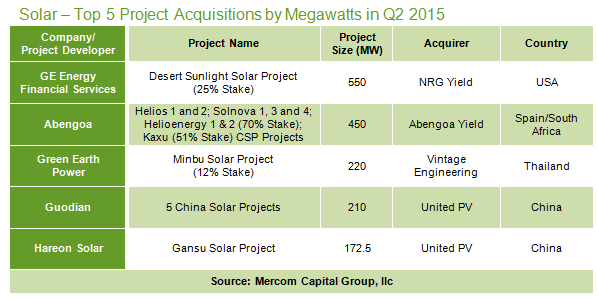

There were 66 large-scale solar project acquisitions totaling $2.9 billion with about 3.5 GW changing hands, compared to 44 transactions in Q1 2015 for $953 million. The top disclosed project acquisition by dollar amount was the $669 million acquisition of four solar projects totaling 450 MW by Abengoa Yield, a dividend growth oriented yieldco which will own, manage and acquire renewable energy, conventional power and electric transmission lines and other contracted revenue-generating assets, from Abengoa, a Spanish multinational corporation and a solar project developer. NRG Yield, a developer of renewable and conventional energy and thermal infrastructure projects and a yieldco subsidiary of NRG Energy, acquired a 25 percent interest in the 550 MW Desert Sunlight solar project in Riverside, California from GE Energy Financial Services for $285 million. United Photovoltaics Group, a Chinese investor and operator of PV projects, acquired 17 solar projects in China from Hareon Solar Technology, a vertically-integrated solar PV manufacturer this quarter. The top acquisitions included the 172.5 MW Gansu solar project for $268.6 million, the 115 MW Hebei solar project for $181 million, and the 100 MW Taiyuan solar project for $163 million.

Mercom also tracked 209 new large-scale project announcements in various stages of development worldwide in Q2 2015 representing 10.4 GW.

Image credit: Shutterstock