Q1 2025 Solar Funding and M&A Report

$299.00 – $499.00

Click here to download the Executive Summary.

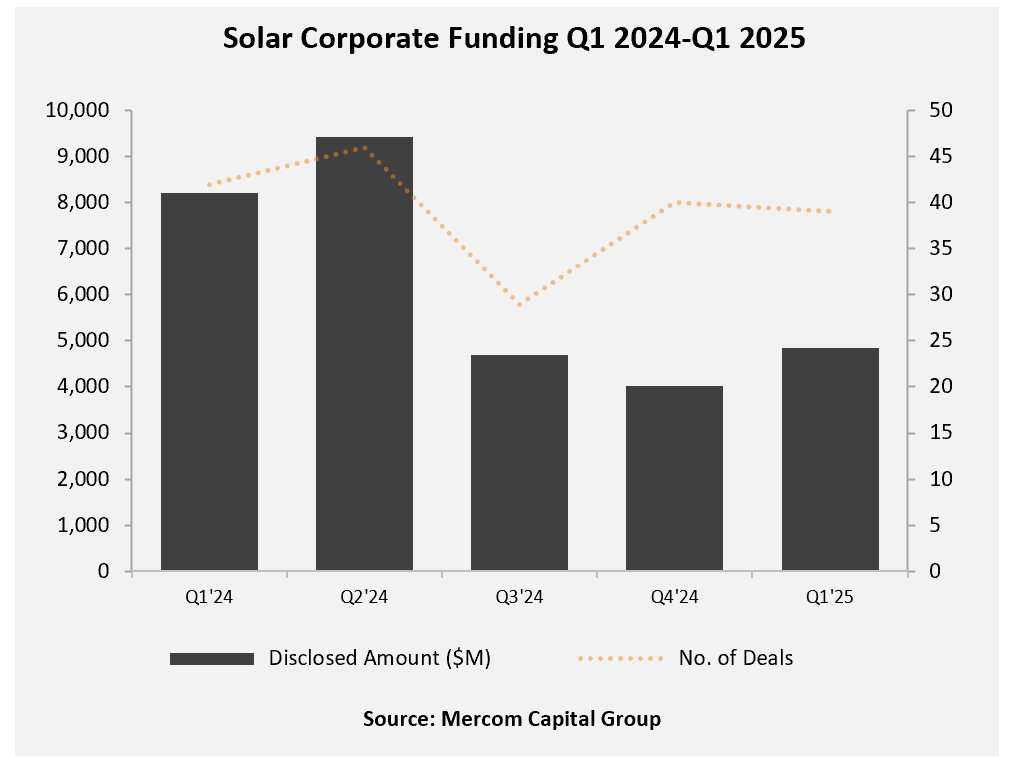

Total corporate funding in the solar sector reached $4.8 billion across 39 deals in Q1 2025—a 41% decline year-over-year (YoY) compared to $8.2 billion raised through 42 deals in Q1 2024. However, funding was up 20% quarter-over-quarter (QoQ) from the $4 billion raised in 40 deals in Q4 2024.

Global VC funding for the solar sector in Q1 2025 came to $1.4 billion in 14 deals, a 237% increase YoY compared to $406 million raised in 13 deals in Q1 2024. Funding increased 40% QoQ compared to the $1 billion raised in 21 deals in Q4 2024. The QoQ increase was primarily driven by a single $1 billion raise.

In Q1 2025, debt financing for the solar sector reached $3.5 billion across 23 deals, a 45% drop compared to the $6.4 billion secured in the same number of deals in Q1 2024. On a QoQ basis, debt funding rose 67% from $2.1 billion across 14 deals in Q4 2024.

A total of 19 solar corporate M&A transactions were recorded in Q1 2025, compared to 20 transactions in Q4 2024, and 10% lower compared to 21 solar M&A transactions in Q1 2024.

Approximately 13.6 GW of solar projects changed hands in Q1 2025, up from 10.8 GW in Q1 2024. On a QoQ basis, project acquisition volume also increased, compared to 9.4 GW in Q4 2024.

There were 263 companies and investors covered in this 91-page report, which contains 69 charts, graphs, and tables.

Mercom Capital Group’s Quarterly Solar Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends, and analysis. These reports help bring clarity to professionals in the current financial landscape of the solar industry.

Also available:

Custom Excel Sheets with all transactions for the quarter, and

Custom Research with data from the past 5 years!

Contact us to learn more and get pricing!

Quarterly market and deal activity displayed in easy-to-digest charts, graphs, and tables, alongside data-driven analysis.

The report covers all types of deals and financing activity, including:

- Venture capital funding deals, including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by technology, sector, stage, and country;

- Large-scale project funding deals, including top investors, QoQ and YoY trends and breakdown charts and graphs by technology and country;

- Public market financing, including equity financing, private placements, and rights issues;

- Debt and other funding deals, as well as QoQ and YoY trends;

- Third-party residential/commercial project funds;

- Large-scale project acquisitions and active project acquirers;

- Large-scale project announcements in various levels of development throughout the world;

- Mergers and acquisitions (M&A), including QoQ and YoY trends, a breakdown of charts and graphs by technology and sector, as well as project M&A activity;

- New cleantech and solar funds;

- New large-scale project announcements;

- Large-scale project costs per MW.

This report also contains comprehensive lists of all announced Q1:

- VC funding, debt financing, public equity financing, and project funding deals;

- VC and project funding investors;

- M&A transactions;

- Project acquisitions by amounts and megawatts;

- M&A, and project M&A transactions;

- Large-scale project announcements.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us here.