2020 Q4 and Annual Solar Funding and M&A Report

$599.00 – $799.00

2020 Total Corporate Funding

Totals $14.5 Billion

– See the Details!

Click here to download the Executive Summary.

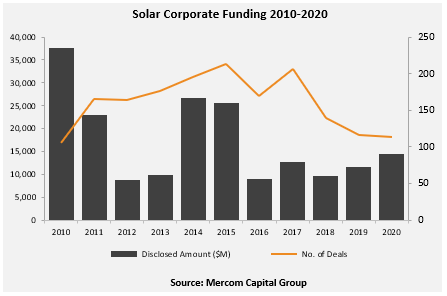

Total corporate funding into the solar sector globally, including venture capital, private equity (VC), debt financing, and public market financing, came to $14.5 billion, a 24% increase compared to the $11.7 billion raised in 2019.

“Following a tough first half when corporate funding was down 25% year-over-year, recovery has been swift and broad, with corporate funding up 24% for the year. Publicly-traded solar companies had an unprecedented year. The solar ETF was up 225%, with 15 solar stocks up over 100% in 2020. Public market funding was also up with the help of several IPOs, and debt financing was up on the back of securitization deals. Solar asset acquisitions were at an all-time high in a pandemic year and have become even more sought-after as an investment haven, especially in the uncertain COVID economy,” said Raj Prabhu, CEO of Mercom Capital Group.

Global venture capital and private equity funding in the solar sector in 2020 came to $1.2 billion in 41 deals, compared to $1.4 billion in 53 deals in 2019.

In 2020, announced debt financing came to $8.3 billion, a 6.4% increase YoY. Eight securitization deals totaling $2.2 billion were recorded in 2020, which was the largest amount of financing through securitization in a year.

There were 231 large-scale solar project acquisitions in 2020 compared to 192 transactions in 2019.

A record 39.5 GW of large-scale solar projects changed hands in 2020 compared to 26.1 GW in 2019. This was the largest amount of projects acquired in a single year to date.

There were 375 companies and investors covered in this 127 page report, which contains 102 charts, graphs, and tables.

Mercom Capital Group’s Quarterly Solar Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the solar industry.

Also available:

Custom Excel Sheets with all transactions for the quarter, and

Custom Research with data from the past 5 years!

Contact us to learn more and get pricing!

Quarterly market and deal activity displayed in easy-to-digest charts, graphs and tables, alongside data-driven analysis.

The report covers all types of deals and financing activity, including:

- Venture capital funding deals, including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by technology, sector, stage and country;

- Large-scale project funding deals, including top investors, QoQ and YoY trends and breakdown charts and graphs by technology and country;

- Public market financing, including equity financing, private placements and rights issues;

- Debt and other funding deals, as well as QoQ and YoY trends;

- Third-party residential/commercial project funds;

- Large-scale project acquisitions and active project acquirers;

- Large-scale project announcements in various levels of development throughout the world;

- Mergers and acquisitions (M&A), including QoQ and YoY trends, a breakdown of charts and graphs by technology and sector, as well as project M&A activity;

- New cleantech and solar funds;

- New large-scale project announcements;

- Large-scale project costs per MW.

This report also contains comprehensive lists of all announced Q4:

- VC funding, debt financing, public equity financing, and project funding deals;

- VC and project funding investors;

- M&A transactions;

- Project acquisitions by amounts and megawatts;

- M&A, and project M&A transactions;

- Large-scale project announcements.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us here.