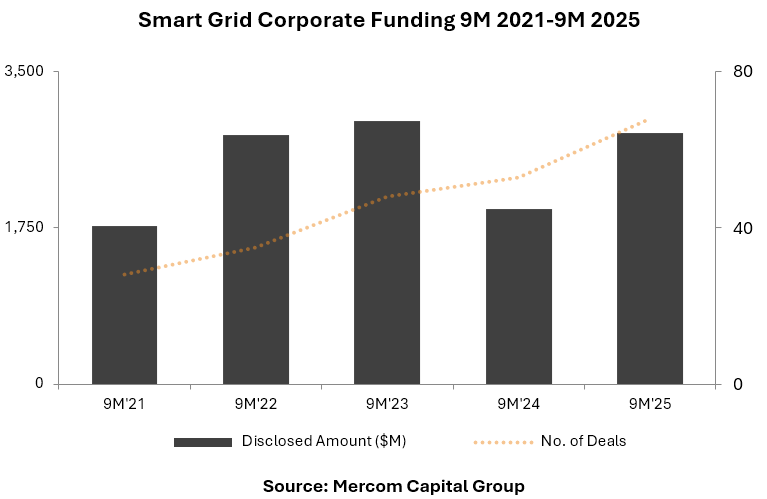

Corporate funding for Smart Grid companies in 9M 2025 reached $2.8 billion in 68 deals, 40% higher year-over-year (YoY) compared to $2 billion in 53 deals in 9M 2024.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-and-q3-2025-funding-and-ma-report-for-smartgrid/

Venture capital (VC) funding for Smart Grid companies in 9M 2025 totaled $1.6 billion across 55 deals, a 14% YoY increase from $1.4 billion across 43 deals in 9M 2024.

Venture capital (VC) funding for Smart Grid companies in 9M 2025 totaled $1.6 billion across 55 deals, a 14% YoY increase from $1.4 billion across 43 deals in 9M 2024.

Smart Charging companies received the most VC funding ($1.1 billion) in 9M 2025. Other top-funded categories included Grid Optimization, Distributed Generation and Integration companies, Data Analytics, and Demand Response companies.

The top Smart Grid VC funding deals in the first nine months of 2025 were: Believ, which raised $410 million; GRIDSERVE, which raised $135 million; WAAT, which raised $116 million; and Connected Kerb and Hubber, each raising $81 million.

Announced debt and public market financing for Smart Grid technology companies totaled $1.25 billion in 13 deals, an increase of 120% YoY compared to $568 million in 10 deals in 9M 2024.

A total of eight Smart Grid M&A transactions were announced in 9M 2025, compared to seven in 9M 2024.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-and-q3-2025-funding-and-ma-report-for-smartgrid/