The first half of 2011 has been less than stellar for the global photovoltaic (PV) markets, but there are some strong indicators that demand pick-up will be much stronger in the second half of 2011. However, we have to add a disclaimer that all bets are off if the European debt crisis cannot be managed, or the US falls back into recession. In short, global economic turmoil of the moment, unless fixed, might become a problem if subsidies are affected or funding gets tougher to secure.

Module prices have fallen tremendously in the last few months from US $1.80 levels in the first quarter to lows in the US $1.20 levels by the end of the second quarter, a significant price drop in a very short time. This steep drop in pricing is anticipated to be the catalyst for accelerated demand in the second half of 2011.

There are several other possibilities that could fuel demand in the last two quarters. Germany announced that there will not be any additional cuts in feed-in-tariffs (FIT) and China recently announced a solar feed-in tariff, an unexpected positive boost for the solar markets. Also of note is the emergence of new markets such as China, India, the UK, Slovakia, and many other European countries which will possibly help supplement anticipated slowing in German and Italian markets.

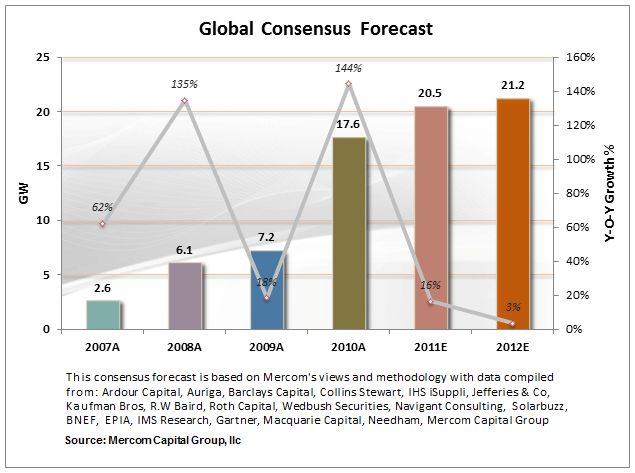

We are forecasting a nominal growth of about ~15 percent over 2010, with a hope that there will be a demand rush in the second half of the year due to the price drops making IRRs in most markets very attractive.

Germany

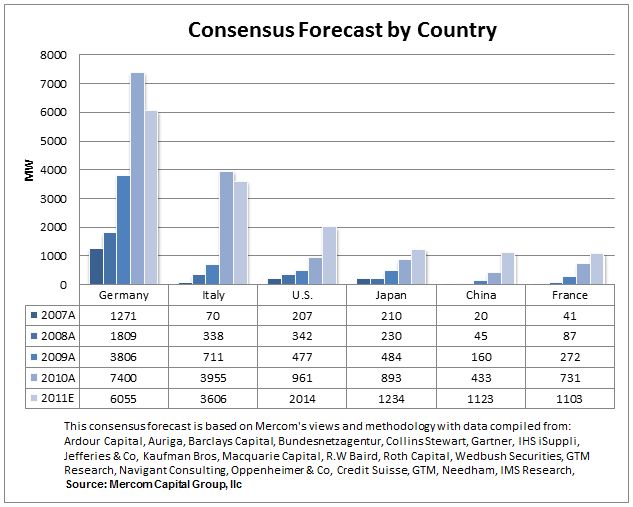

Germany installed 7.4GW of solar PV in 2010 and was the largest solar market. Demand has since slowed with only about 1GW installed through the end of May of this year. This slow down meant that no further cuts to feed-in-tariffs were announced in July, which, along with falling prices and attractive IRRs are likely to drive increased demand in the second half of 2011.

Another important development in Germany has been the decision to shut down all 17 nuclear power plants in phases by 2022. This translates to 20GW of base load power to be replaced. The market is speculating that this development may help solar, though it is not clear how at this point, as solar is not a substitute for baseload power. Under current market conditions, the consensus forecast in Germany points to about 6GW to be installed in 2011.

Italy

There is finally some policy clarity in Italy with the approval of new legislation which will help push installations in the second half of 2011. The new feed-in-tariff plan will decline on a monthly basis through the end of 2011 and then will decline using a six month schedule through 2016. According to new legislation, small systems under 1MW installed on rooftops are uncapped. Small systems include 1) roof top projects under 1MW; 2) ground projects under 200kW under net metering, and 3) plants on land owned by the public administration. This uncapped small systems segment is expected to be driven by demand.

The wild card in Italy is the current debt crisis with the government trying to put an austerity program in place. It remains to be seen if Italy’s deficit reduction plan will impose any further cuts to renewable energy incentives, especially solar.

France

France introduced a 500MW hard cap on annual new installations and 20 percent FIT cuts for projects under 100kW. France is also one of the first countries in Europe to shift from a feed-in-tariff system to a bidding system for above 100kW, large-scale projects.

The only thing supporting the French market in 2011 is the exemption of about 3.5GW of grandfathered systems. About 2GW of these are expected to be installed in 2011 and 2012.

United States (U.S.)

The United States has been the rising star in solar with about 1GW installed in 2010 and with expectations of doubling that number in 2011. The U.S. still does not have a central, cohesive solar incentive policy; instead, the market is driven by state renewable portfolio standards, state and municipal rebate programs, and 30 percent federal investment tax credit (ITC) and loan guarantee programs.

The U.S. solar market is driven by utility scale projects unlike European markets dominated by small systems. The popular 30 percent treasury cash grant program will expire at the end of 2011 unless renewed and may fuel a rush to install by year end. Under the current political conditions in Washington, it will take a miracle for the treasury grant to be extended.

China

The Chinese National Development and Reform Commission (NDRC) just announced a solar feed-in-tariff without a cap, but the projects are subject to NDRC approval. According to the new policy, projects approved before July 1, 2011 and completed by December 31, 2011 will receive an FIT of US $0.18/kWh. Projects approved after July 1, 2011 or completed after December 31, 2011 will receive an FIT of $0.156/kWh. This feed-in-tariff does not apply to other PV programs such as the Golden Sun program that are receiving government subsidies.

The policy is still in its early stages with a lot to be clarified, but the fact that China has an FIT and is working toward a goal of 10GW by 2015 and 40-50GW by 2020 is a huge positive for the industry. If China’s solar industry follows the trajectory of China’s wind industry, all bets are off.

Japan

Japan may end up shutting down all of its 54 nuclear power plants by year end according to Japanese Trade Ministry officials. How this will affect renewable energy sectors, specifically solar, is unclear. Again, nuclear power is base load and solar is not. Japan at the moment is struggling with regular power shortages since the Fukushima disaster. Japan has set a goal of achieving 28GW of cumulative PV by 2020. Rooftop installations drive the Japanese PV market and further FIT increases are proposed for coming periods.

It looks like we are entering a much more active second half of the year and if demand picks up as per indications, we could see nominal growth in 2011 solar installations over 2010.