After a tumultuous first half, with huge price drops and uncertainty on just about everything, we are finally seeing some positive signs in terms of demand pick up. With the module prices now in the $1.00 – $1.10 (USD) range amounting to almost a 40 percent drop in prices compared to the $1.80 levels in the first quarter, one might expect a huge spike in demand but it did not happen.

Demand elasticity has been slow to show up in most markets taking a while to respond to low module prices mainly due to weak and unpredictable economic conditions in Europe and with the future of Eurozone itself in question, depending on the day of the week. As a result, a difficult financing environment exists in Europe adding to the problems. The economy in the United States is recovering very slowly and politically the support for renewable energy subsidies is just not there.

There are some signs of hope. News has been more positive in the last few weeks as Germany finally reported a pick-up in demand. With low module prices, high IRR’s and a looming 15 percent cut in feed-in-tariff in January 2012, hope is that there will be a big rush in the last few months. The cash grant in the United States is set to expire at the end of this year and with the current political conditions in Washington, chances for an extension of the cash grant is almost zero. This could create a mini rush in the U.S.

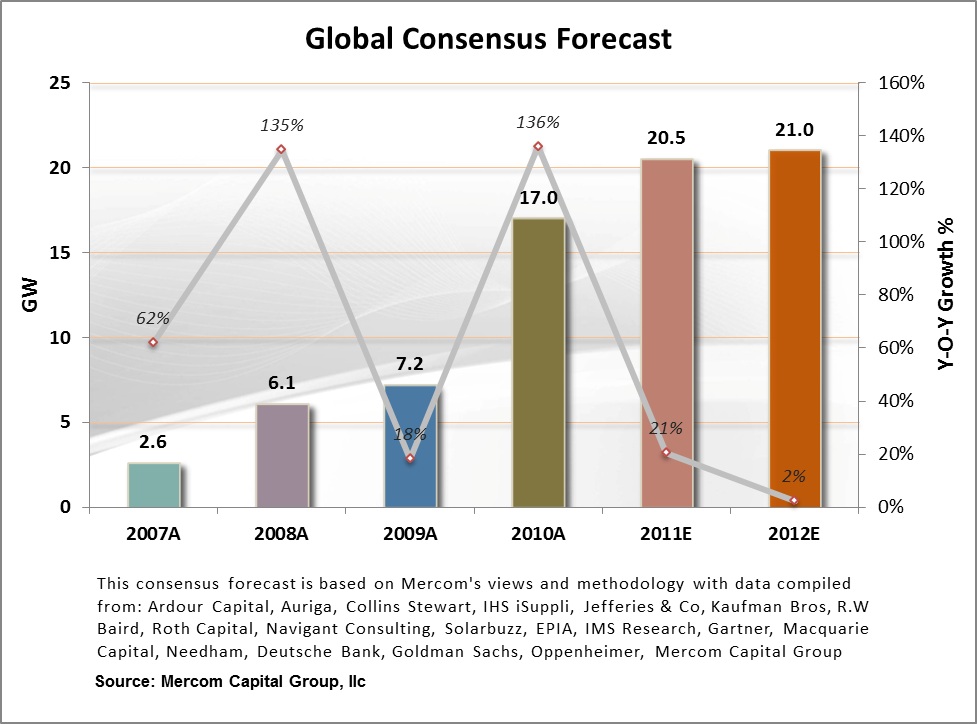

We are forecasting a 20 percent growth for 2011 over 2010, with the hope that the year-end rush in Germany and the U.S. will give the market a much needed final push. 2012 at this point looks flat compared to 2011, with economic uncertainty and feed-in-tariff cuts in Germany, cash grant expiry in the U.S. and tariff cuts in Australia and Taiwan. There are potential risks involving subsidy decisions in Italy, Greece, Slovakia and others.

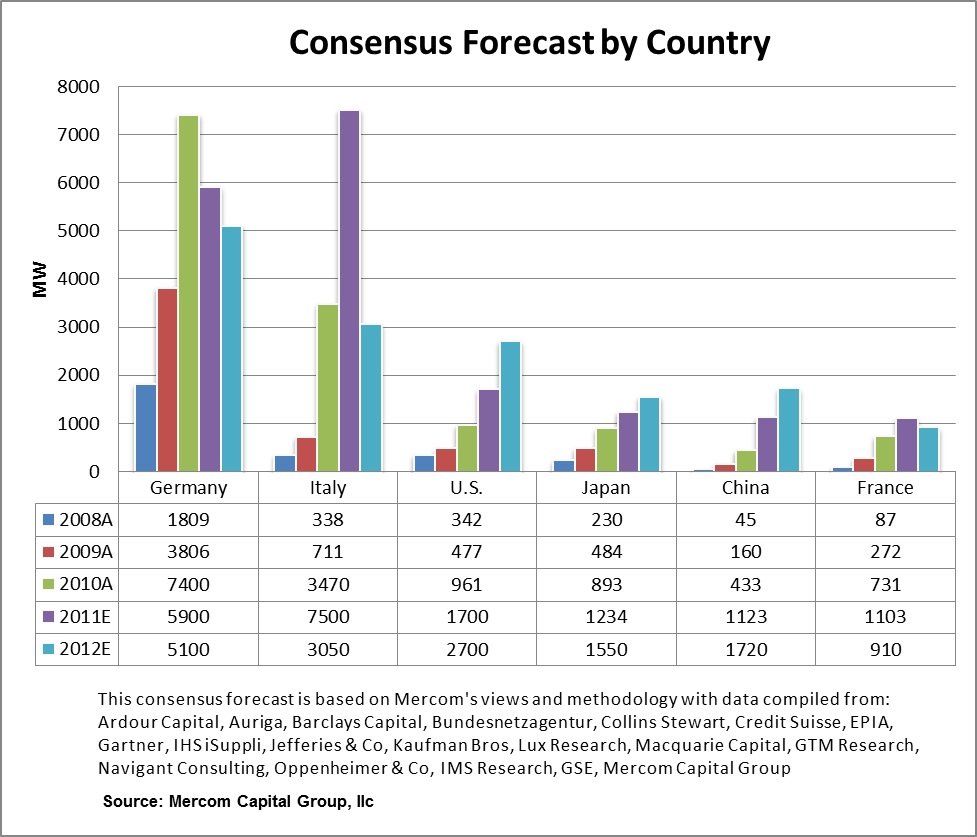

Germany

The German market is finally showing signs of life. After a lackluster first half, Germany installed about 2.2GW between the months of June, July, August and September 2011. Germany installed around 5.2GW in the 2012 feed-in-tariff reference period between October 2010 and September 2011, resulting in a 15 percent cut in feed-in-tariff as it crossed the growth threshold of >4,500MW starting January 1, 2012. In addition, the new German renewable energy law, EEG, introduced mid-year tariff cuts from 2012 onwards. The feed-in-tariff cut effective July 1, 2012 is based on annualized installations from October 1, 2011 to April 31, 2012 which could result in a further 9 percent cut in 2012.

There has been an uptick in demand in the last few months and signs are that October 2012 was a strong month. With a 15 percent cut in feed-in-tariff starting January 1, 2012, the market is expecting a “big rush” to install before the tariff cuts; therefore we are forecasting installations of about 6GW in 2011.

The market in 2012 looks softer in Germany with coming feed-in-tariff cuts (15-24 percent), recent slowdown in economic activity, financing difficulties and uncertainty in the Eurozone in general, all pointing to slower growth.

Italy

After the ongoing confusion about installations in Italy, the Italian Gestore dei Servizi Energetici (GSE) now states that 3.5GW was grid connected in calendar year (CY) 2010. Year-to-date 6.5GW has been installed in 2011 according to GSE, and it anticipates installations of about 8.5GW by year end. This would make Italy the top solar market in 2011.

The new law, Quarto Conto Energia went into effect on June 1, 2011. The new feed-in-tariff plan will decline on a monthly basis through the end of 2011 and then will decline using a six month schedule through 2016. According to the new legislation, small systems under 1MW installed on rooftops are uncapped. Small systems include 1) roof top projects under 1MW; 2) ground projects under 200kW under net metering; and 3) plants on land owned by the public administration. This uncapped small systems segment is expected to be driven by demand.

It will be impossible for Italy to sustain these levels of installations going forward as volume caps shrink and feed-in-tariff cuts continue in 2012. Even more of a risk factor is the ongoing Italian debt crisis and the Berlusconi government itself hanging by a thread.

France

France is also right in the middle of the Eurozone crisis with huge economic and political uncertainties in the near future.

France is one of the first countries in Europe to shift from a feed-in-tariff system to a bidding system for large-scale projects, above 100kW. France introduced a 500MW hard cap on annual new installations and 20 percent feed-in-tariff cuts for projects under 100kW.

The only thing supporting the French market in 2011 is the exemption of about 3.5GW of grandfathered systems. About 2GW of these are expected to be installed in 2011 and 2012.

United States (U.S.)

The United States installed almost 900MW in 2010 and the market has been expecting that this number will double in 2011. Even with rapidly declining module prices in the first half of the year, the market was not exactly spectacular. The wild card is the 30 percent treasury cash grant program, which will expire at the end of 2011 and may fuel a year end rush, unless renewed.

Under the current political conditions in Washington and the recent bankruptcies of Department of Energy backed Evergreen Solar, Solyndra, Spectrawatt and Beacon power, the cash grant extension looks dead with the chances of renewal close to zero. The administration has also recently ordered a review of the Energy Department’s loan program.

The U.S. still does not have a central, cohesive solar incentive policy; instead, the market is driven by state renewable portfolio standards, state and municipal rebate programs, and 30 percent federal investment tax credit (ITC) and loan guarantee programs. While California, which is the largest solar market within the United States, is fueled by an aggressive RPS, states like New Jersey relied on Solar Renewable Energy Certificates (SREC) for growth. The market for projects in New Jersey has declined after the recent collapse in SREC prices in that state, which was the second largest solar market in the U.S., other SREC dependent states may suffer similar plight.

China

China has so far been a solar exporter rather than an end-market. The Chinese National Development and Reform Commission (NDRC) announced a solar feed-in-tariff without a cap, but the projects are subject to NDRC approval. According to the new policy, projects approved before July 1, 2011 and completed by December 31, 2011 will receive an FIT of US $0.18/kWh. Projects approved after July 1, 2011 or completed after December 31, 2011 will receive an FIT of $0.156/kWh. This feed-in-tariff does not apply to other PV programs such as the Golden Sun program that are receiving government subsidies.

The policy is still in its early stages with a lot to be clarified, but the fact that China has an FIT and is working toward a goal of 10GW by 2015 and 40-50GW by 2020 is a huge positive for the industry.

There is a lot of focus on China right now after some American manufacturers filed a trade complaint against China disputing the subsidies offered by the Chinese government to Chinese manufacturers. With a difficult year coming up, 2012 will be a great year for China to announce some strong policies to spur domestic demand which may help the solar industry globally. The module prices are low enough for China to turn its attention from exporting panels to start consuming them.

Japan

Japan may end up shutting down all of its 54 nuclear power plants by year end, according to Japanese Trade Ministry officials. How this will affect renewable energy sectors, specifically solar, is still unclear. Again, nuclear power is base load and solar is not. Japan at the moment is struggling with regular power shortages since the Fukushima disaster and has set a goal of achieving 28GW of cumulative PV by 2020.

Japan announced a new clean-energy law coming into effect on July 1, 2012 but the feed-in-tariff levels are still unclear. The country’s parliament passed a bill on August 26, 2011 that guarantees feed-in-tariff rates for wind, solar and geothermal energy. The bill is one of the first steps by Japan to promote the renewable energy industry in view of the recent Fukushima disaster. Under the law, the trade and industry ministry will set rates and periods each year.

Currently, the tariff for residential solar power is ~$0.54 per kilowatt-hour, while the tariff for commercial installations is ~$0.52 per kilowatt-hour. Even though there is no clarity yet on what the tariffs might look like next year, it is generally a positive for the solar industry.