Energy Storage

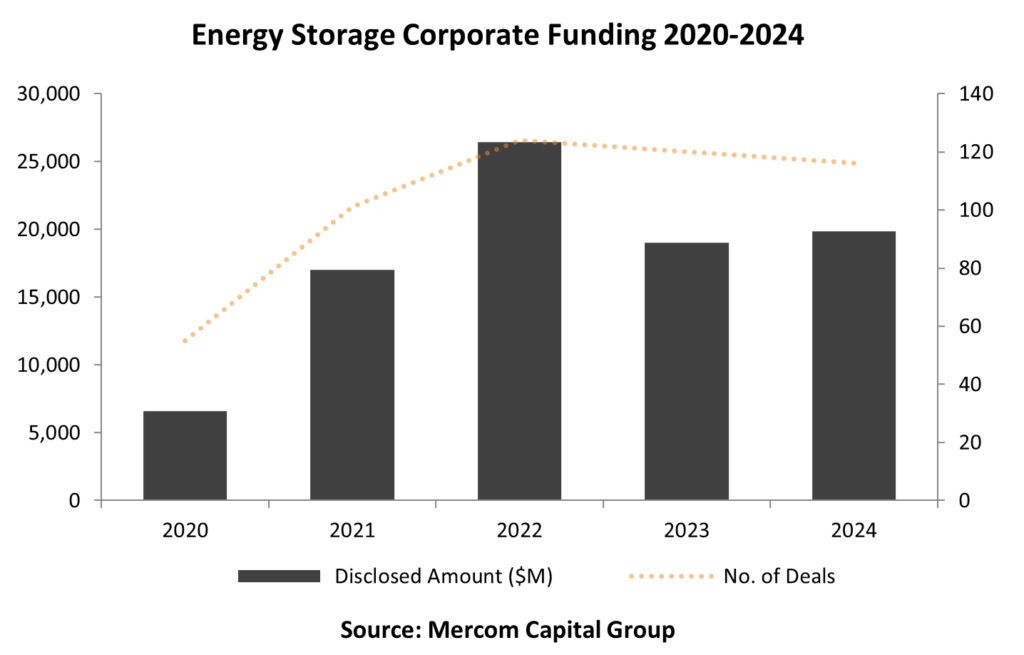

Corporate funding for Energy Storage Companies, including venture capital (VC) funding, debt, and public market financing, reached $19.9 billion in 116 deals in 2024, a 5% increase year-over-year (YoY) compared to $19 billion in 120 deals in 2023.

To get a copy of the report, visit: https://mercomcapital.com/product/annual-q4-2024-funding-ma-report-storage-grid/

However, VC funding in the Energy Storage sector in 2024 decreased 60% YoY, with $3.7 billion in 84 deals compared to $9.2 billion in 86 deals in 2023.

However, VC funding in the Energy Storage sector in 2024 decreased 60% YoY, with $3.7 billion in 84 deals compared to $9.2 billion in 86 deals in 2023.

Lithium-ion-based (Li-based) Battery technology companies received the most VC funding in 2024. Other top-funded categories included Materials and Component providers, Iron-air battery providers, Battery Recycling companies, and Metal-Hydrogen battery companies.

The Top 5 Energy Storage VC funding deals in 2024 were by Form Energy, which raised $405 million; Sila Nanotechnologies, which raised $375 million; EnerVenue Holdings, which brought in $308 million; Natron Energy, which raised $189 million; and Ascend Elements, which raised $162 million.

Announced debt and public market financing for Energy Storage companies in 2024 increased 65% YoY, with $16.2 billion in 32 deals compared to $9.8 billion in 34 deals in 2023.

Corporate energy storage M&A activity increased, with 25 companies acquired in 2024 versus 15 in 2023.

In 2024, 38 energy storage projects were acquired, in comparison, 2023 saw 28 project M&A transactions.

Smart Grid

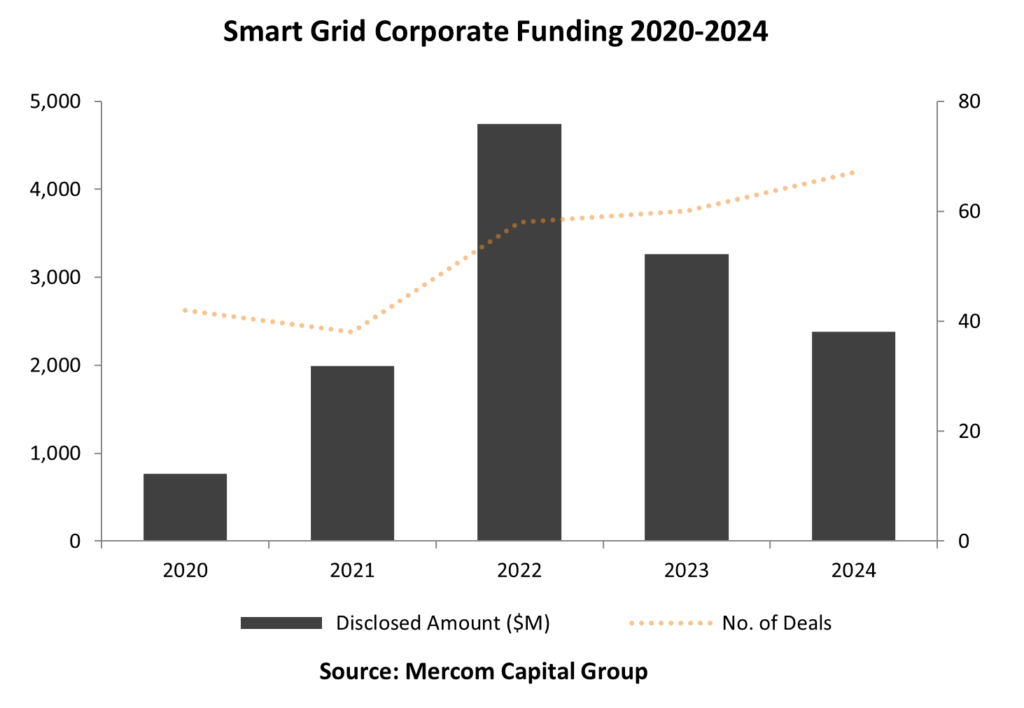

Corporate funding for Smart Grid companies in 2024 was 27% lower YoY, with $2.4 billion in 67 deals compared to $3.3 billion in 60 deals in 2023.

VC funding in the Smart Grid sector increased 13% YoY with $1.7 billion in 56 deals in 2024 compared to $1.5 billion in 47 deals in 2023.

VC funding in the Smart Grid sector increased 13% YoY with $1.7 billion in 56 deals in 2024 compared to $1.5 billion in 47 deals in 2023.

Smart Charging companies raised most of the VC funding in 2024. Other Categories that raised VC funding in 2024 included Data Analytics, Distributed Generation and Integration, Demand Response, and Grid Optimization.

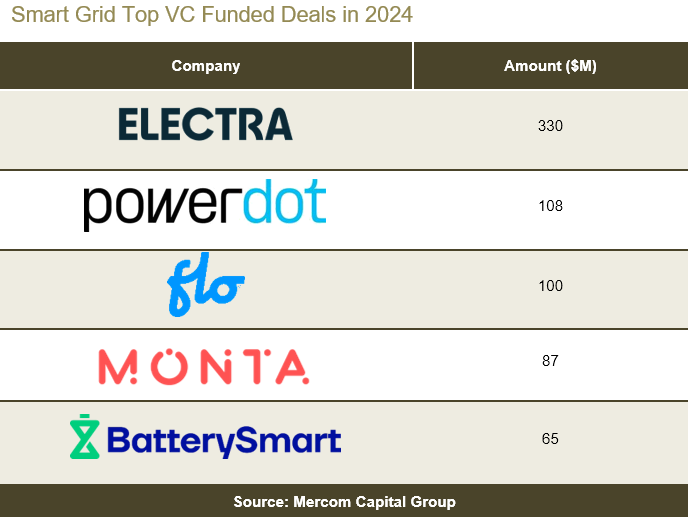

The Top 5 Smart Grid VC funding deals in 2024 were Electra with $330 million, Powerdot with $108 million, FLO with $100 million, Monta with $87 million, and Battery Smart with $65 million.

In 2024, 11 debt and public market financing deals were announced, totaling $718 million, compared to $1.8 billion raised in 13 deals in 2023.

In 2024, there were 10 M&A transactions in the Smart Grid sector, compared to 11 transactions in 2023.