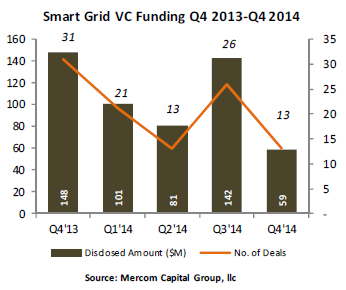

Venture capital (VC) funding into smart grid technology companies was $383 million in 73 deals in 2014, compared to $410 million in 64 deals in 2013. Total corporate funding, including debt and public market financings, came to $844 million in 2014, compared to $584 million in 2013. There were 88 total VC investors in 2014, with eight active investors participating in multiple deals.

To get a copy of this report, please email us at info@mercomcapital.com.

Home automation companies received the most funding within Smart Grid.

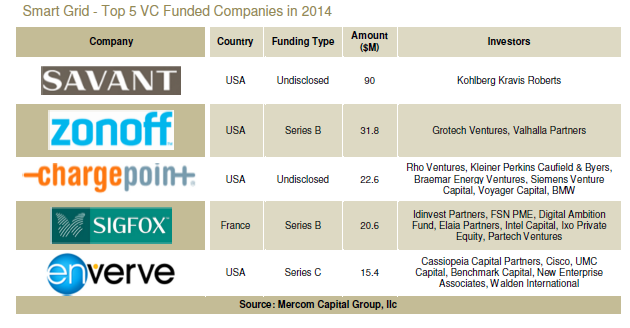

The Top VC funded companies in 2014 were led by Savant Systems, which raised $90 million. Zonoff brought in $31.8 million; this was followed by the $22.6 million raise by ChargePoint. SIGFOX raised $20.6 million and EnVerv, raised $15.4 million.

The top VC investors in 2014 included BDC Capital, Constellation Technology Ventures, Emertec Gestion, Israel Cleantech Ventures, Qualcomm, Siemens Venture Capital, VantagePoint Capital and Voyager Capital with two deals each.

There were 32 Smart Grid M&A transactions (12 disclosed) in 2014 totaling $3.9 billion. The top disclosed transaction in 2014 was Google’s acquisition of Nest Labs for $3.2 billion, followed by the $200 million acquisition of SmartThings by Samsung Electronics and the $150 million acquisition of Aclara Technologies by Sun Capital Partners. Bel Fuse acquired Power-One’s Power Solutions business for $117 million and Sierra Wireless acquired Wireless Maingate for $90 million.

In 2014, Mercom expanded its coverage to include Storage/Battery and Energy Efficiency sectors.

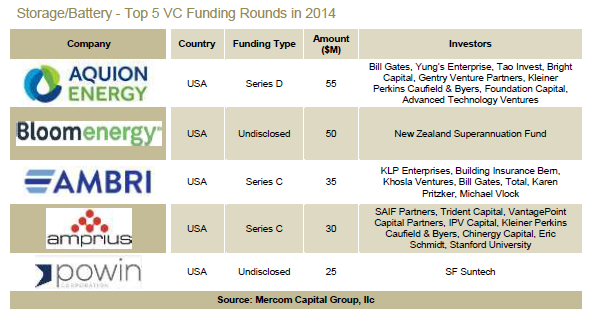

Companies in the Storage/Battery space received $418 million in 32 deals. The top VC funding deal in 2014 was the $55 million raise by Aquion Energy, followed by Bloom Energy, which raised $50 million. Ambri (formerly Liquid Metal Battery Corporation) raised $35 million, Amprius raised $30 million and Powin Energy raised $25 million.

Sodium-based Storage/Battery companies received the most funding with $112 million.

There were also 19 debt and public market financing deals in Storage/Battery totaling $490 million including one Initial Public Offering in 2014. There were two third-party storage funds announced to finance no-money, no-upfront, behind-the-meter storage projects.

M&A transactions in Battery/Storage totaled 18, of which six transactions were disclosed, totaling $232 million.

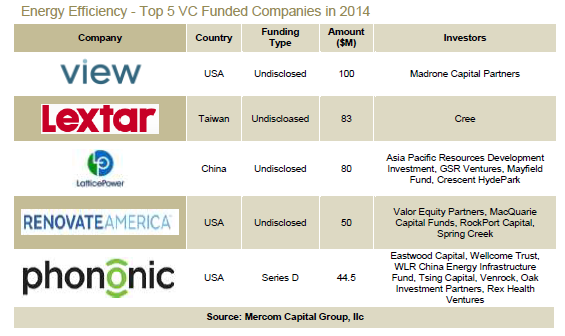

Energy Efficiency companies raised $797 million in 80 deals in 2014. The top VC deal was the $100 million raise by View (formerly Soladigm), followed by Lextar Electronics, which raised $83 million. LatticePower brought in $80 million, Renovate America raised $50 million and Phononic raised $44.5 million.

Lighting technology companies received the most funding in the Energy Efficiency sector with $315 million.

Energy Efficiency companies also raised $410 million in debt and public market financings with two IPOs – Opower and Lumenpulse in 2014.

There were 26 M&A transactions this year in the Energy Efficiency category.