2018 Q4 and Annual Solar Funding and M&A Report

$599.00 – $799.00

2018 Total Corporate Funding

Totals $9.7 Billion

– See the Details!

Click here to download the Executive Summary.

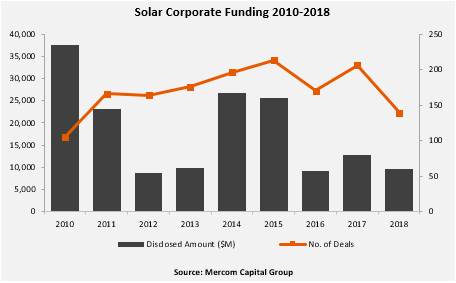

Total global corporate funding into the solar sector, including venture capital and private equity (VC), debt financing, and public market financing came to $9.7 billion, a 24 percent drop compared to the $12.8 billion raised in 2017.

“2018 was a year filled with uncertainties which started with Section 201 tariffs followed by an announcement from China that it was capping installations and reducing its feed-in-tariff. More bad news came from India which imposed safeguard duties on imports. Uncertainty stemming from the three largest solar markets in the world was reflected in equities of publicly-traded solar companies as well as fundraising activity during the year,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

Global VC funding for the solar sector in 2018 fell 18 percent to $1.3 billion in 65 deals, compared to $1.6 billion raised in 99 deals in 2017.

In 2018, announced debt financing fell 36 percent with $6 billion in 53 deals, compared to $9.5 billion raised in 74 deals during 2017. There were five securitization deals totaling $1.4 billion, slightly higher than the $1.3 billion in 2017.

Large-scale project funding announced in 2018 came to $14 billion in 183 deals, similar to the $14 billion raised in 167 deals during 2017. A total of 182 investors funded about 15 GW of large-scale solar projects in 2018 compared to 20.5 GW funded by 161 investors in 2017.

The solar sector set a record in 2018 for project acquisitions with 29 GW compared to the 20.4 GW in 2017. There were 218 large-scale solar project acquisitions (54 disclosed for $8.4 billion) in 2018 compared to 228 transactions (92 disclosed for $8.3 billion) in 2017.

“About 100 GW of large-scale projects have been acquired since 2010, a reflection of how far solar has come as an asset class. Quality solar projects are now a mature, attractive investment opportunity around the world,” added Prabhu.

There were 306 companies and investors covered in this report. It is 120 pages in length and contains 107 charts, graphs, and tables.

Mercom Capital Group’s Quarterly Solar Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the solar industry.

Also available:

Custom Excel Sheets with all transactions for the quarter, and

Custom Research with data from the past 5 years!

Contact us to learn more and get pricing!

Quarterly market and deal activity displayed in easy-to-digest charts, graphs and tables, alongside data-driven analysis.

The report covers all types of deals and financing activity, including:

- Venture capital funding deals, including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by technology, sector, stage and country;

- Large-scale project funding deals, including top investors, QoQ and YoY trends and breakdown charts and graphs by technology and country;

- Public market financing, including equity financing, private placements and rights issues;

- Debt and other funding deals, as well as QoQ and YoY trends;

- Third-party residential/commercial project funds;

- Large-scale project acquisitions and active project acquirers;

- Large-scale project announcements in various levels of development throughout the world;

- Mergers and acquisitions (M&A), including QoQ and YoY trends, a breakdown of charts and graphs by technology and sector, as well as project M&A activity;

- New cleantech and solar funds;

- New large-scale project announcements;

- Large-scale project costs per MW.

This report also contains comprehensive lists of all announced Q4:

- VC funding, debt financing, public equity financing, and project funding deals;

- VC and project funding investors;

- M&A transactions;

- Project acquisitions by amounts and megawatts;

- M&A, and project M&A transactions;

- Large-scale project announcements.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us here.