Solar

Disclosed investments in the solar sector totaled $1.7 billion out of 30 transactions. Solar merger and acquisition (M&A) transactions in the first quarter totaled $784 million in six disclosed deals out of a total of 10 deals.

Forms of investment included venture capital (VC) funding, financing and loans, with VC investments coming in at $297.75 million in 18 deals and all other financing and loans totaling $1.4 billion in 12 deals. Significant investments in solar include a $760 million project financing for Torresol Energy, a $250 million credit facility for MEMC and a $120 million debt and equity financing for Atlantic Wind and Solar, Inc.

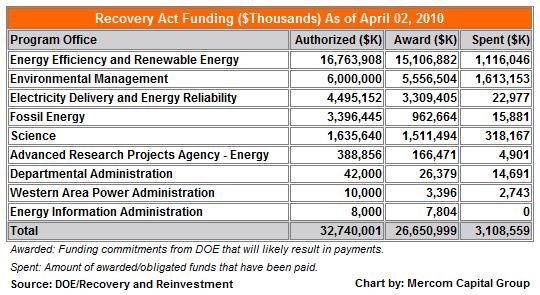

According to the Department of Energy (DOE) just $3.1 billion, representing only 12% of awarded funds, has actually been spent as of April 2, 2010. DOE has awarded a total of $26.7 billion so far. Out of $3.1 billion, a total of $1.4 billion was spent in the first quarter of 2010.

Smart Grid

Disclosed investments in the smart grid sector totaled $112.13 million for 15 transactions. Smart grid merger and acquisition (M&A) transactions in the first quarter was $10 million in one disclosed deal out of a total of seven deals.

Forms of investment included venture capital (VC) funding, financing and loans, with VC investment coming in at $89.13 million in 12 deals and other financing and loans totaling $23 million in three deals. Significant investments in smart grid include a $31 million VC funding for Cymbet and a $20 million revolving credit facility for Comverge.

Raj Prabhu, Managing Partner of Mercom Capital Group, commented, “Mercom has expanded its reporting beyond venture capital transactions to include other types of financing and M&A transactions. This gives the industry a truer picture of what is happening in finance and M&A as it relates to solar, wind and smart grid.”