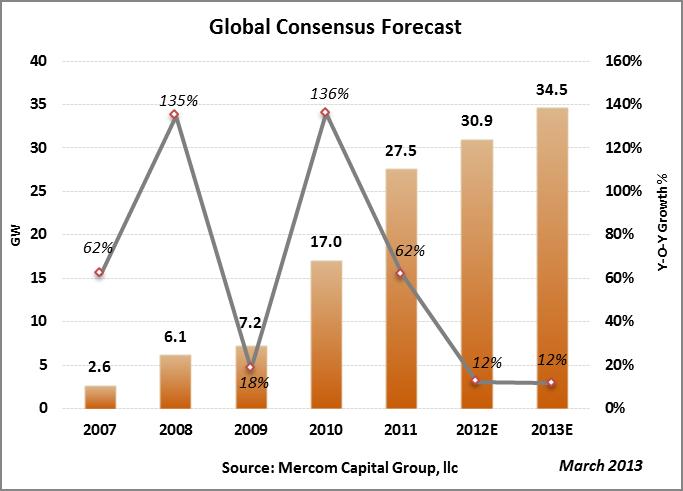

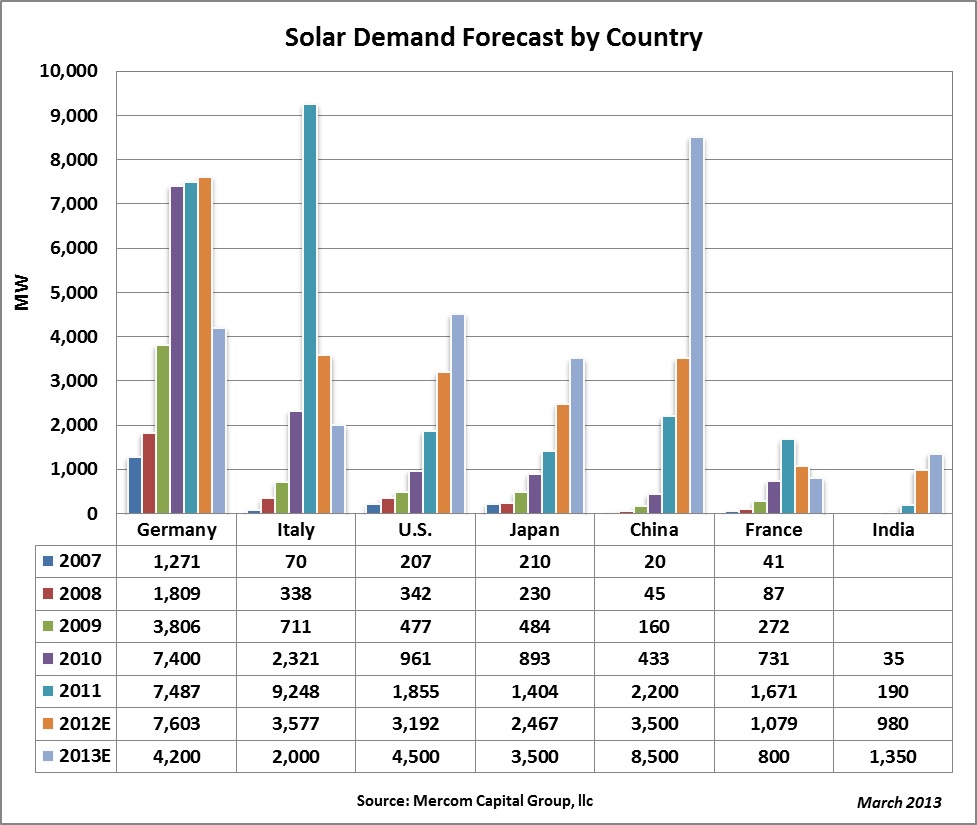

Despite all the struggles experienced by the industry over the past few years, global solar installations still managed to grow, mainly due to Germany defying expectations and installing 7.6 GW in 2012. Final installation numbers are still trickling in and it looks like the global installations for 2012 will be in the 30-32 GW range. We are forecasting 2013 installations at 34.5 GW.

While 2012 was a year dominated by overcapacity and bankruptcies. The other major topic that consumed the industry, and will continue to do so in 2013, are the trade wars.

Anti-dumping cases and protectionist measures became all too common all over the world as countries tried to rescue their own manufacturers in the face of massive over supply and ever-falling prices. So far, we have seen the United States announce final anti-dumping tariffs against Chinese manufacturers followed by the European Union filing a similar case also against China. Meanwhile, China announced its own anti-dumping case against polysilicon suppliers from the United States, EU and South Korea while India recently initiated an anti-dumping investigation on the imports of solar cells against Malaysia, China, Taiwan and the United States, further escalating the solar trade wars. The latest to join the list was the EU initiating an anti-dumping investigation in late February 2013, into the imports of solar glass from China.

Low module prices (overall c-Si module prices dropped by roughly 30 percent in 2012) have continued to drive installations, though prices began to stabilize around November 2012, with Tier-1 spot c-Si module prices increasing from around 0.65/W to 0.67/W currently.

Along with Germany, some of the markets that drove installation growth last year were Italy, China, France, Japan, United States, India, and the UK. Greece, Bulgaria, Belgium and Australia were also major contributors.

Based on current forecasts it looks like the significant share of installations in 2013 will come from emerging solar markets like China, Japan and India. Though the 2013 forecast points to another year of growth, the effects of the growth might not be felt in the same way as before. Eight GW installed in Germany is not the same as eight GW installed in China. Penetrating these markets will be much more challenging for foreign suppliers and service providers.

Germany

PV installations in Germany totaled 7,603 MW for 2012 making it another year of record growth, despite the German Federal Network Agency (Bundesnetzagentur) efforts to slow the market. Germany has had a remarkable stretch of record installations over the last three years installing 7,400 MW in 2010, 7,500 MW in 2011 and 7,600 MW in 2012.

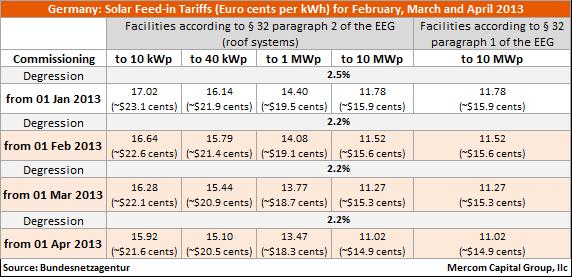

In an effort to slow down installations, Bundesnetzagentur announced a reduction in feed-in tariffs (FiT) for PV installations between November 1, 2012, and January 31, 2013, where FiTs decreased by 2.5 percent per month. The reduction seems to be working as installations slowed to 435 MW in November, 300 MW in December and just 275 MW in January 2013.

Having seen the success in slowing installations by monthly reductions of 2.5 percent, the Bundesnetzagentur announced in February 2013, that it will continue the monthly tariff reductions between February and April 2013 at a slightly lower rate of 2.2 percent.

Cumulative PV installations in Germany stood at 32.7 GW as of January 2013. Germany’s goal is to subsidize its solar program up to 52 GW.

Italy

Italy replaced its solar policy, Conto Energia IV, with Conto Energia V, which calls for a €700 million (~$900 million) subsidy cap and also provides a FiT premium for solar panels made in Europe to the tune of ~€20 (~$25)/MWh. According to Gestore dei Servizi Energetici (GSE), the annual cost of PV incentives paid out so far has reached €6.57B (~$8.55 billion) as of February 2013. The Conto Energia V program will come to an end once the annual costs of incentives reach €6.7 billion ($8.7 billion). After that cap is reached, Italy will no longer offer incentives for new PV installations. Italian PV incentives will end after the remaining €130 million (~$169 million) is used up for PV incentives.

Preliminary PV installation numbers for 2012 from GSE indicate that Italy installed about 3,577 MW. With the Conto Energia cap almost reached, Italian PV installations will further slowdown, but the positive for Italy is that most parts of the country have already reached grid parity due to a combination of excellent solar insolation and high electricity costs. Italian projects have one of the higher ROIs among developed markets.

United States

The United States continues its strong installation growth and is expected to have installed in the 3,000-3,500 MW range in 2012 compared to about 1,850 MW in 2011. The continued growth in installations comes with the help of utility-scale projects; third party financed residential and commercial installations and state Renewable Portfolio Standards. Solar lease programs, where consumers lease systems instead of making the upfront investment, are extremely popular, especially in California, and are largely driving the residential markets there.

The United States is also still involved in several trade disputes even with the uncertainty surrounding the anti-dumping case against Chinese manufacturers complete – the final ruling was released in November. So far, the impact from the anti-dumping ruling seems to have had minimal impact on installations and panel prices. Other ongoing trade cases include the anti-dumping case filed by China against the U.S. polysilicon makers, and an anti-dumping case filed by India against the United States in regards to solar panels. Though the outcomes of these trade disputes may not be bad, there nevertheless will be a level of uncertainty until these cases are settled.

The United States does not have a central, cohesive solar incentive policy. Instead, the market is driven by state Renewable Portfolio Standards (RPS), state and municipal rebate programs and the 30 percent federal investment tax credit (ITC). California, the largest solar market in the country, is fueled by an aggressive RPS of 33 percent by 2020. Almost 30 states have some sort of RPS in place, and about half of them have a solar carve-out.

Japan

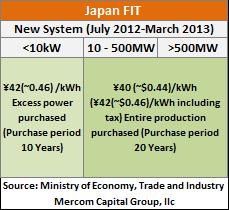

Japan has set a goal of achieving 28 GW of cumulative PV installations by 2020. The Ministry of Economy, Trade, and Industry (METI) announced a FiT program in June 2012, valid for 20 years, which is one of the most attractive in the world right now, with PV systems below 10 kW receiving ¥42/kWh (~$0.53) and systems above 10 kW receiving ¥40/kWh (~$0.51). For systems less than 10 kW, the government will purchase only the excess power produced for a 10 year period. For systems larger than 10 kW, the government will purchase all of the power produced. The new FiT program is designed to stimulate new large-scale power projects, as there was no FiT available for projects 500 kW or higher previously.

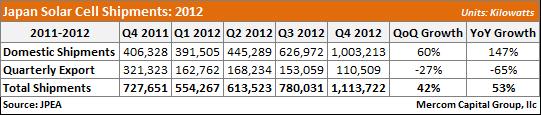

The generous FiTs and high rate of returns have helped spur growth, and final PV installation numbers in 2012 are expected to be in the 2,500 MW range. In tune with installations, domestic PV shipments have continued to rise as well.

METI approved about 3.25 GW of solar projects just in the seven months between April to November 2012. However, METI is now recommending lower FiTs for PV projects in Japan, though it doesn’t specify new rates. As we predicted in our third quarter forecast update, the FiTs were too generous and can lead to a boom-bust cycle.

China

In our forecast from the fourth quarter we noted that the National Energy Administration (NEA) of China had set a solar power capacity target of 21 GW by 2015. The original goal for solar installations was five GW by 2015, and continued to be revised to 10 GW, 21 GW and now the latest target set is a very aggressive 40 GW by 2015; the installation target set for 2013 is 10 GW. There is also a push for stronger policy support to distributed PV, partly in response to grid issues.

China’s solar industry still faces multiple challenges including economic slowdown, tightening credit by the state owned banks, significant debt exposure to solar manufacturers, bankability issues, low tariffs, bureaucracy, cumbersome permitting processes, and transmission bottlenecks (a big hurdle also facing the wind sector), along with trade disputes.

Initial solar installation goals in China were modest, aimed at some environmental benefits and the need for renewable sources of generation. Billions in credit were provided on the supply side to manufacturers to ramp-up capacity, which had the unintended result of creating massive overcapacity and a steep fall in prices, which put most manufacturers on life support. Continued government support in the form of loans and credit were not enough to rectify the situation and stronger domestic installation goals had to be set to absorb some of the excess supply. The goals have gotten increasingly more aggressive in tune with the problems faced by domestic manufacturers. The government has gotten more serious with its solar goals as solar is now seen as a solution to the serious air pollution problems in China. The Chinese Ministry of Environmental Protection has called for more stringent air quality standards and has targeted active monitoring and forecasting PM2.5 (particulate matter) data. The ministry has also identified coal consumption and automobiles as the major source of these environmental problems.

The Chinese government announced that it allocated about $2 billion for the second round of projects for its Golden Sun Program in 2012, and a direct subsidy of $0.40/W. There is allowance for regional adjustments to the FiTs based on local resource conditions and preferential VAT policies. The BIPV subsidies for 2013 are in the $1.20/W to $1.40/W range for approved projects.

It has to be noted that unlike other markets, most forecasts for China are basically government goals.

France

PV installations in France for 2012 were about 1.1 GW.

France has been all over the place when it comes to solar policies, cutting its FiTs several times in 2012, followed by a shift from a FiT system to a bidding system for large-scale projects above 100 kW. However, there was some good news in the form of fresh policy support from the new Hollande administration. The current FiT is very generous compared to Germany and includes support for rooftop projects; there is also a “Made in EU” bonus of 5 -10 percent on top of the FiT.

India

Indian solar installations have been driven by the Jawaharlal Nehru National Solar Mission (JNNSM) with a goal to install 20 GW of solar power by 2022, and various state policies and state RPOs.

India installed 980 MW in 2012, slightly lower than our forecast of 1,090 MW. The difference was largely due to delays in Gujarat to commission 144.5 MW of PV projects; most states missed their renewable portfolio obligations (RPO) goals as enforcement is almost non-existent. Cumulative installations to date in India now stand at over 1.2 GW. In addition, there are 340 MW of PV projects due to be connected to the grid in March 2013 under the JNNSM Phase I, Batch 2 policy. We are forecasting India to install another 1.3 to 1.4 GW in 2013.

The Ministry of New and Renewable Energy (MNRE) recently proposed a draft Phase II policy and opened it up for comments. Phase II would have a target of achieving 3,000-9,000 MW of solar power through various batches as previously seen in Phase I.

Here is a detailed update of the Indian solar market.

This consensus forecast is based on Mercom’s views and methodology with data compiled from: Barclays Capital, BNEF, Bundesnetzagentur, Citi, Collins Stewart, Credit Suisse, Daiwa, Deutsche Bank, Enerplan, EPIA, EUPD, GTM Research, GSE, Hyundai, ICBC, IHS iSuppli, Jefferies, JP Morgan, JPEA, Kaufman Bros, KGI, Macquarie Capital, Maxim Group, Mercom Capital Group, METI, NEA, Piper Jaffray, R.W. Baird, Solarbuzz, Stifel Nicolaus, UBS, and other government, public and private sources.